Markets have recently shown signs of discontent, with the ups-and-downs of the not-so-transparent negotiations between the US and China frustrating investors and harming sentiment. The recent renminbi devaluation, though small in scale, is still a sign that China is far from being knocked out, while the US president is never short of a vindicating tweet. In the meantime, macro data is not bad, but not good either and we see pockets of heightened risk. Finally, inflation is nowhere to be found and this situation is in itself a puzzle for central bankers. These headwinds lead us to wonder what could cause markets to rally from here, moving from an uprising to rising up: looking beyond today’s volatility, here is our “what if” analysis. In our opinion, the current macro picture gives cause for concern: the German IFO indicator reached 95.7 – a level last reached in 2012; 70% of the European Commission survey data is declining; the US ISM moved from 60.8 in 2018 to 51.2 in August – nearing the psychological 50 threshold; and in China, the growth rate of imports, probably one of the best proxies for the evolution of China’s consumption, plunged from 27% in 2018 to 0% today. Where can we see potential improvements to this overall negative macro picture?„Uprising“ – Muse, 2009

What’s Next?

The macro picture could improve

First of all, even if these numbers have proven to be reliable gauges of the economic health of these economies, there are other figures showing a different picture. In the case of the US, the CFNAI indicator is still hovering around its expansion period average, the Atlanta Fed GDPNow sees Q3 GDP in the US at around 2% while the NY Fed one sees it slightly below this mark. Our own Growth Nowcaster agrees with US growth settling around this 2% level in Q3, lifted by solid job and housing markets.

More importantly, as the Fed will continue to loosen its monetary policy, the more interest rate-driven parts of the economy (durable goods consumption, housing and investment) will be even more stimulated than they are today. For example, car sales have been muted so far, but with short-term rates heading lower, households could make the decision to change their cars. It should also be noted that personal income growth in the US is more than 3% higher than short-term rates, which is a reasonable incentive for households to increase their short-term debt.

In the case of China, the government and central banks have some leeway to stimulate the economy and have shown over the past 15 years their ability to be wise pilots. The situation that worries us the most is Europe and, more importantly, Germany. However, even here, there are reasons to be hopeful. First, Chinese imports have stabilised over the past couple of months and are no longer collapsing (Europe is China-dependent). Second, the ECB is giving clear signs of being on the dovish side and sustaining credit conditions. If the US growth cycle starts improving, this outside stimulation could feed off these good credit conditions, finally leading European consumers to find the confidence they lack to engage in longer-term commitments. The picture is in no way rosy, but things could turn more positive in a matter of months, mainly because credit could finally deliver on its promises.

The trade war could stabilise, lifting sentiment

A trade war stabilisation would be a second potential trigger to higher markets by year-end. There are reasons to be optimistic beyond the events of the past few days. Firstly, China is now showing muscle and it has done so twice already. Between July 2018 and April 2019, China imported only a third of the oil it had imported from the US in 2017. In addition, the limited currency devaluation is another sign of resistance to the US government’s push. Going forward, two elements are likely to become important and put a halt to this lose-lose situation. Firstly, there is a limit to the devaluations that China can action without it seeing massive outflows in its foreign direct investments – something that the country’s future still depends on. Secondly, the US elections are nearing and Donald Trump cannot afford to end his mandate on a recession (even if his recent attitude is inconsistent with this fact). The year-to-date collapse in global trade is already a threat to his re-election and he has already acknowledged that certain tariffs will hurt the US consumer.

Simultaneously, world trade indices over the past couple months have either recovered or stabilised. The CPB World Trade volume index is currently at its November 2017 level and only 2% lower than its maximum in November 2018. The Baltic Dry Index staged a superb 200% recovery between mid-June and mid-August this year, though it went largely unnoticed. Chinese freight indices also embarked on a similar, though less pronounced, evolution. In short, world trade today is far better off than it was in April and any additional improvement on this front would be a further positive factor, pushing sentiment in the right direction.

Finally, the best ally to markets recently have been central banks. Inflation risk is low as most of the drivers of inflation are currently heading south. Core inflation in the US is at 2.2%, while headline inflation is at 1.8%, reflecting today’s very poor commodity cycle. In the Eurozone, core inflation has had a stable evolution to around 1%. The striking pattern across developed market economies is that this low inflation situation looks like it is structural: wage growth and capacity utilisation rates remain solid but, with slower growth and commodity cycles, inflation remains low. This is a preoccupying situation and the basic mission of most central banks is to align inflation to their long-term targets of around 2%. This is good news globally, with bond and equity investors able to enjoy the comforting support of central banks piloting the credit cycle and helping inflation back toward its long-term target without too much risk of an overheating. The Fed and the ECB have been intensively playing this card this year and in spite of the decelerating macro momentum, equities and bonds rallied. We do not expect a change in their stance: the Fed should keep on cutting rates in the coming quarters and the ECB will do what it can to buy enough time for European governments to decide on spending more. With the recent market correction, valuations look even more attractive when placing them in the context of this supportive monetary policy environment. Aligning these three factors (macro, sentiment and valuation) could lead to a positive Q4 in terms of growth asset performance. This, for the moment, remains an extremely rosy scenario and almost too good to be true. It also relies on an absence of unpredictable tweets. Seasonality is usually not great from mid-August to mid-September, but recent positioning in equities decreased as spreads widened, offering a better risk-reward balance for credit bonds holders. For now, this is more of a “what if” analysis than anything else. But we will remain attentive to these three sign-posts in order to avoid missing the transition from markets uprising to markets rising up.Accommodative monetary policy makes valuations attractive

Uprising

Our medium-term view is currently more constructive, as we are pairing an overweight in growth assets with an overweight in government bonds and an underweight in industrial metals. We are also complementing our exposures with options to protect the portfolio in the case of equity drawdowns. Over the month of August to date, the Uni-Global – Cross Asset Navigator fund has lost 0.77% versus a fall of 4.31% for the MSCI AC World Index and a gain of 1.86% for the Barclays Global Aggregate (USD hedged). Year-to-date, the Uni-Global – Cross Asset Navigator has returned 7.59% versus 11.55% for the MSCI AC World index, while the Barclays Global Aggregate (USD hedged) index is up 8.83%.Strategy Behaviour

Performance Review

Unigestion Nowcasting

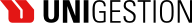

World Growth Nowcaster

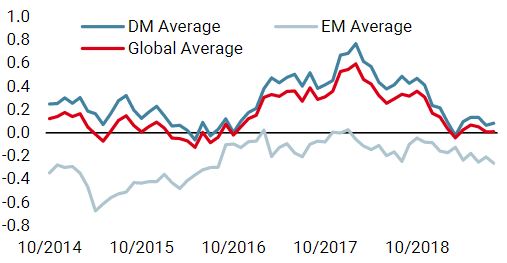

World Inflation Nowcaster

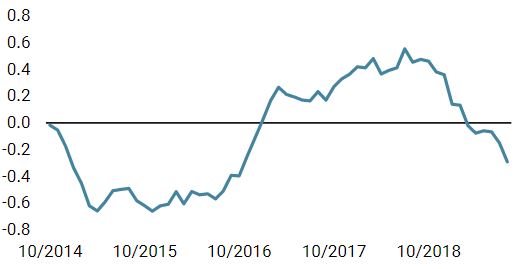

Market Stress Nowcaster

Weekly Change

- Our world Growth Nowcaster dropped marginally last week, driven by lower growth conditions in the developed world.

- Our world Inflation Nowcaster remains low, but stopped decreasing last week, more because of a lack of data rather than because of a stronger signal.

- Market stress decreased last week, as volatility and credit spreads decreased.

Sources: Unigestion. Bloomberg, as of 26 August 2019.

Navigator Fund Performance

| Performance, net of fees | 2018 | 2017 | 2016 | 2015 |

| Navigator (inception 15 December 2014) | -3.6% | 10.6% | 4.4% | -2.2% |

Past performance is no guide to the future, the value of investments can fall as well as rise, there is no guarantee that your initial investment will be returned.

Important Information

Past performance is no guide to the future, the value of investments, and the income from them change frequently, may fall as well as rise, there is no guarantee that your initial investment will be returned. This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed by recipients to any other person. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in the investment vehicles to which it refers. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Please contact your professional adviser/consultant before making an investment decision.

Where possible we aim to disclose the material risks pertinent to this document, and as such these should be noted on the individual document pages. The views expressed in this document do not purport to be a complete description of the securities, markets and developments referred to in it. Reference to specific securities should not be considered a recommendation to buy or sell. Investors shall conduct their own analysis of the risks (including any legal, regulatory, tax or other consequences) associated with an investment and should seek independent professional advice. Some of the investment strategies described or alluded to herein may be construed as high risk and not readily realisable investments, which may experience substantial and sudden losses including total loss of investment. These are not suitable for all types of investors.

To the extent that this report contains statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. Actual results could differ materially from those in the forward-looking statements. As such, forward looking statements should not be relied upon for future returns. Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modelling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of this information. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. Rates of exchange may cause the value of investments to go up or down. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

Uni-Global – Cross Asset Navigator is a compartment of the Luxembourg Uni-Global SICAV Part I, UCITS IV compliant. This compartment is currently authorised for distribution in Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Spain, UK, Sweden, and Switzerland. In Italy, this compartment can be offered only to qualified investors within the meaning of art.100 D. Leg. 58/1998. Its shares may not be offered or distributed in any country where such offer or distribution would be prohibited by law.

No prospectus has been filed with a Canadian securities regulatory authority to qualify the distribution of units of these funds and no such authority has expressed an opinion about these securities. Accordingly, their units may not be offered or distributed in Canada except to permitted clients who benefit from an exemption from the requirement to deliver a prospectus under securities legislation and where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the applicable offering memorandum which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses.

All investors must obtain and carefully read the prospectus which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses. Unless otherwise stated performance is shown net of fees in USD and does not include the commission and fees charged at the time of subscribing for or redeeming shares.

Unigestion UK, which is authorised and regulated by the UK Financial Conduct Authority, has issued this document. Unigestion SA authorised and regulated by the Swiss FINMA. Unigestion Asset Management (France) S.A. authorised and regulated by the French Autorité des Marchés Financiers. Unigestion Asia Pte Limited authorised and regulated by the Monetary Authority of Singapore. Performance source: Unigestion, Bloomberg, Morningstar. Performance is shown on an annualised basis unless otherwise stated and is based on Uni Global – Cross Asset Navigator RA-USD net of fees with data from 15 December 2014 to 26 August 2019.