A little over a year ago, we communicated that the possibility of a trade war was the greatest source of uncertainty for the second half of 2018. Today is not very much different. After a sense of optimism during the first quarter of this year, investors have started to face the reality that a US-China trade deal is not as close as some tweets would have them believe. Interestingly, the impact of the previous round of tariffs can now be measured, giving us a better sense of what to expect with this latest round. Moreover, Washington has signalled what the next front on this war could be, with specific technology firms and their products brought into the fray. Yet when we look at market pricing, it seems to us that investors continue to expect a resolution, though perhaps not such a positive one as before. This discounting of the downside scenarios has us feeling like we’re spinning “right round, right round like a record, right round round round.” Over the last few weeks, concerns about global trade have resurfaced, driven by the White House following through on its threat to raise tariffs from 10% to 25% on USD 200bn of Chinese imports. Investors had been lulled into complacency by talk and tweets about progress in US-China trade meetings during the first quarter of this year and got a rude awakening when talks fell apart and the tone shifted toward escalation. It seems to us that the direct negative impact to global growth of the implemented tariffs is somewhat limited, roughly in the range of 0.15-0.20% over the next three years. Importantly, this contraction could be offset by fiscal spending in the US or China. While global inflation is unlikely to move much, the US is particularly exposed. A recent study by the National Bureau of Economic Research (NBER) demonstrated that the 2018 tariffs on US imports were completely passed through to end consumers as higher prices. Another study by a team of economists from Harvard, Chicago, the IMF, and the Federal Reserve, using price data from the Bureau of Labor and statistics on imports from China, demonstrated a sharp, nearly one-to-one rise in prices for goods hit by the 10% or 25% tariff, whereas the border price (ex-tariff) was largely unchanged. Thus, US importers (households or businesses) have almost entirely borne the brunt of higher tariffs, with Chinese exporters not yet engaging in price cuts. The new rounds of tariffs will essentially go into effect on June 1, and we would expect a similar dynamic to hold, with the tariff in effect acting as a tax on US importers. Some of these higher import prices will pass to US consumers as higher end-product prices, while others will be absorbed by importing firms via lower profit margins. Fiscal spending could help to offset the likely demand contraction (e.g., via industry subsidies or another round of tax cuts funded by the tariff revenue), but it is important to keep in mind deadweight losses, in this case caused by tariff-driven shifts in supply chains from a Chinese producer to a less efficient producer. These deadweight losses are not recovered by the government and hence cannot be used to fund fiscal spending. The NBER study determined that the 2018 tariffs cost US households on average USD 414 annually, USD 132 of which is deadweight loss. Building on this work, the IMF determined that the additional 15% on the USD 200bn of imports will cost US households USD 831 annually, USD 620 of which will be a deadweight loss. To put these figures in context, this would mean that about 75% of the lost income households will face from this round of tariffs will not be going to government coffers but is rather welfare destruction due to inefficiencies. Keep in mind that the total tariff bill per household in the US would move up to USD 1,245, above the average tax cut of USD 1,090 that the middle quintile of income earners received from the 2017 tax reform according to the non-partisan Tax Policy Center.„YOU SPIN ME ROUND (LIKE A RECORD)“ – DEAD OR ALIVE, 1984

What’s Next?

Reassessing the impact of the US-China trade war

The US is exposed via more channels than just inflation

Our discussion thus far has been about what has currently been implemented, but looking ahead, further escalation looks quite worrying. In the near term, the comment period for the next wave of tariffs – 25% tariffs on nearly all remaining Chinese imports, totalling about USD 300bn – ends on 24 June, shortly before the G20 meeting set for June 28-29. Though this round may be delayed, we see a significant chance of these tariffs being implemented. The White House has also made clear that the trade war will not be just about tariffs. It has now expanded its actions to include: curtailing US exports of sensitive technology to key Chinese firms like Huawei, limiting Chinese input to critical telecommunications systems and scrutinising Chinese investments in US firms. At the same time, Chinese policymakers could limit exports of key input materials needed by US firms, leading to yet another spiral of escalations. Of course, it is very difficult to say where this could end or what the costs could be, but it seems to us that tariffs are unlikely to be the final battle of this war. Last year, we estimated that a significant escalation of the trade war would trim about 9% from global equities, mostly due to an expansion in risk premia. We think that number is still in the right ballpark from where we stand today. Yet the MSCI All Country World Index is down just a little over 4% since its recent peak in early May, suggesting the market still sees a significant chance of a trade deal happening and discounting the likelihood of the final round of tariffs or the battlefront shifting beyond tariffs. We are not so starry-eyed and continue to protect against an equity sell-off via options.But this is the status-quo scenario, not the downside scenario

And yet investors continue to look on the bright side

You Spin Me Round (Like A Record)

Our medium-term view remains cautious, and we are pairing a small overweight in government bonds with an underweight in emerging assets. We are also complementing our equity exposure with options to protect the portfolio in the case of equity drawdowns. Over the month so far, the Uni-Global – Cross Asset Navigator fund is down 1% versus -4.1% for the MSCI AC World Index, while the Barclays Global Aggregate (USD hedged) is up 0.8%. Year-to-date, the Uni-Global – Cross Asset Navigator has returned 4.3% versus 11.2% for the MSCI AC World index and 3.9% for the Barclays Global Aggregate (USD hedged).Strategy Behaviour

Performance Review

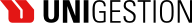

Unigestion Nowcasting

World Growth Nowcaster

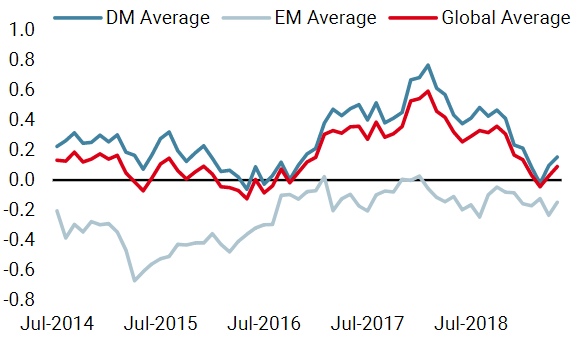

World Inflation Nowcaster

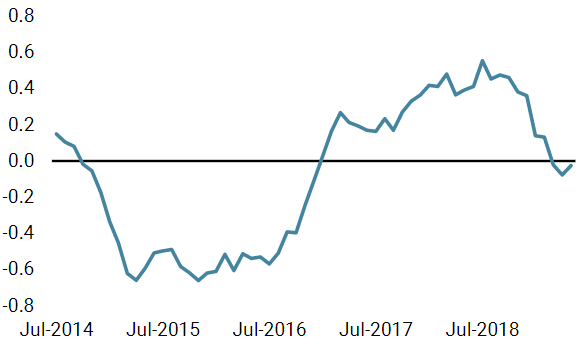

Market Stress Nowcaster

Weekly Change

- Our world Growth Nowcaster increased last week, on the back of stronger macro data in the US, China and South Africa.

- Our world Inflation Nowcaster increased again this week, largely driven by stronger US inflation data.

- Market stress increased over the past week, with credit spreads getting wider and liquidity conditions deteriorating.

Sources: Unigestion, Bloomberg, as of 27 May 2019.

Past performance is no guide to the future, the value of investments can fall as well as rise, there is no guarantee that your initial investment will be returned. Important Information Past performance is no guide to the future, the value of investments can fall as well as rise, there is no guarantee that your initial investment will be returned. This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed by recipients to any other person. This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in the investment vehicles it refers to. Please contact your professional adviser/consultant before making an investment decision. Where possible we aim to disclose the material risks pertinent to this document, and as such, these should be noted on the individual document pages. A complete list of all the applicable risks can be found in the Fund prospectus. Some of the investment strategies described or alluded to herein may be construed as high risk and not readily realisable investments, which may experience substantial and sudden losses including total loss of investment. These are not suitable for all types of investors. To the extent that this report contains statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. As such, forward looking statements should not be relied upon for future returns. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of this information. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. Rates of exchange may cause the value of investments to go up or down. An investment with Unigestion, like all investments, contains risks, including total loss for the investor. Uni-Global – Cross Asset Navigator is a compartment of the Luxembourg Uni-Global SICAV Part I, UCITS IV compliant. This compartment is currently authorised for distribution in Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Spain, UK, Sweden, and Switzerland. In Italy, this compartment can be offered only to qualified investors within the meaning of art.100 D. Leg. 58/1998. Its shares may not be offered or distributed in any country where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the prospectus which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses. Unless otherwise stated performance is shown net of fees in USD and does not include the commission and fees charged at the time of subscribing for or redeeming shares. Unigestion UK, which is authorised and regulated by the UK Financial Conduct Authority, has issued this document. Unigestion SA authorised and regulated by the Swiss FINMA. Unigestion Asset Management (France) S.A. authorised and regulated by the French Autorité des Marchés Financiers. Unigestion Asia Pte Limited authorised and regulated by the Monetary Authority of Singapore. Performance source: Unigestion, Bloomberg, Morningstar. Performance is shown on an annualised basis unless otherwise stated and is based on Uni Global – Cross Asset Navigator RA-USD net of fees with data from 15.12.2014 to 27.05.2019.Navigator fund performance

Performance, net of fees

2018

2017

2016

2015

Navigator (inception 15 December 2014)

-3.6%

10.6%

4.4%

-2.2%