The last three US recessions were not caused by inflation but rather by the bursting of asset bubbles driven by the Fed’s own easy-money policies. They occurred after economic growth and inflation had remained positive (though subdued) for extended periods. As a direct result of low interest rates and unconventional monetary policy, investors were forced out on the risk curve, scrambling for yields. European high yield corporate bonds, aka junk bonds, which traded at an effective yield of 26% in December 2008, collapsed to a low of 2% in October 2017. This is one of the most incredible central bank induced distortions of all time. Has the corporate bond market become “hooked on junk” again? The corporate bond market has boomed, tripling in size from the peak of the prior cycle in 2007. During that period, the corporate bond ETF market has expanded by over ten times. As with the structured mortgage products in 2008, investors seem to be complacent about the debt products they (are forced to) own. In 2007, the lie was that you could take a bunch of low-quality loans, package them together and somehow get a AAA-rated bond. This time, the lie is that you can take a bunch of bonds that trade by appointment, lump them together in an ETF, and magically make them liquid. Investors are desperate for yield and US companies are happy to tap this additional source of cheap money to lever up for stock buybacks, dividends and M&A, given the investor appetite for such financial engineering. The result is that US equity markets trade close to all–time highs while corporate balance sheets deteriorate. Of particular concern is the BBB-rated corporate debt market. It is considered “investment grade,” but it sits on the lowest rung of the ladder. When BBB debt gets downgraded just one notch by ratings agencies to BB, it becomes a “fallen angel” and is reclassified from investment grade to high yield. Importantly, at that point, many institutions, including endowments, pension funds and certain bond funds, are typically handcuffed with legal and/or self-imposed limits based on credit quality and must sell these holdings. Many investors still believe the investment grade corporate bond market to be the safest slice of their portfolio pie, but they should treat the BBB portion of the bond market for what it is: a medium to high-risk slice of the corporate debt pie. At the peak of the last cycle in 2007, the total investment grade market was USD 1.7 trillion, and BBB-rated debt accounted for under 25% of the total. Since then, we have experienced the second longest economic expansion on record in the United States. The investment grade market has ballooned to over USD 5 trn, with BBB-rated debt accounting for over 50% of the total. If half of the BBB-rated bonds were to be downgraded, it would entail a shift of USD 1.3 trn bonds to junk status. To put that into perspective, the entire junk market today is less than USD 1.25 trn, and the subprime mortgage market that caused so many problems in 2008 peaked at USD 1.3 trn.“Hooked on Junk” – k.d. lang, 1984

What’s Next?

Too much money chasing too few deals

Credit cycles do not die of age and leverage alone …

… but the past suggests danger is on the way

Years of balance sheet re-leveraging and, in some cases, lingering structural challenges have greatly diminished the ability of many corporations to withstand negative growth shocks. Throughout the first quarter this year, profit forecasts have tumbled and many investors worry that profit margins have peaked as the fiscal stimulus wears off. The threats are a combination of faster wage growth, global growth deceleration and concerns around global trade. If we see a less-friendly macro backdrop, the most indebted businesses will begin to run into trouble.

Additionally, it is very likely that the rating agencies will be far more proactive with downgrades when merited this time after they faced much scrutiny and criticism during the great financial crisis for failing to meet their responsibilities in the mortgage market. Even if only a small part of the immense BBB market were to be downgraded, investors with investment grade mandates could be forced to offload large amounts of bonds quickly. The knock-on effect to the high yield market would be catastrophic as it would swamp the much smaller and illiquid junk bond market with supply. This would come at a time when corporations are facing record levels of repayment requirements over the coming years.

Even though we are cautious on corporate credit, and especially the BBB segment, we do not considering shorting investment grade-rated bonds. The market believes that the Fed will counter with aggressive interest rate cuts (currently, a cut of almost 50 bps is priced in by year-end) which will be very supportive for investment grade bonds. Additionally, every CFO is conscious that retaining an investment grade rating will be key to surviving a major crisis. These companies need the credit market to not worry about their balance sheet, and whether or not they will be able to refinance those debts that mature in the near future. Confidence is everything.The obvious trade will not be the money maker

Regaining market confidence will not be shareholder-friendly, but rather creditor friendly. Corporates will likely cut down on equity buybacks, dividends, M&A and capital expenditures to maintain their rating. It could be a troubling indicator for equity markets, if the biggest buyers of stocks during the recent bull market withdraw. Recently, another danger signal showed up: New corporate offerings have jumped to their highest level in years. Is the corporate crowd starting to feel that stocks are overdone?

High yield reads like a bond, but trades like a stock. We keep our defensive stance and continue to protect our equity and high yield bond exposure with a convex equity derivatives overlay.

Hooked on Junk

Our medium-term view remains cautious and we are pairing a small overweight in government bonds with an underweight in emerging assets. We are also complementing our equity exposure with options to protect the portfolio in case of equity drawdowns. For the month of May, the Uni-Global – Cross Asset Navigator fund was down 1.68% versus -5.93% for the MSCI AC World Index, while the Barclays Global Aggregate (USD hedged) was up 1.44%. Year-to-date, the Uni-Global – Cross Asset Navigator has returned 3.62% versus 9.08% for the MSCI AC World index and 4.54% for the Barclays Global Aggregate (USD hedged).Strategy Behaviour

Performance Review

Unigestion Nowcasting

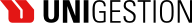

World Growth Nowcaster

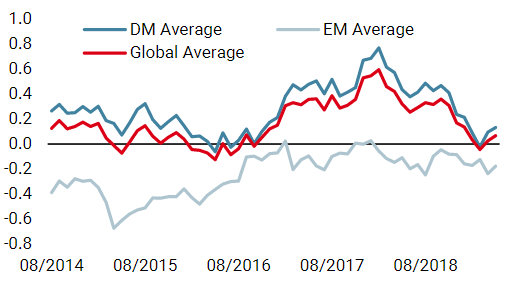

World Inflation Nowcaster

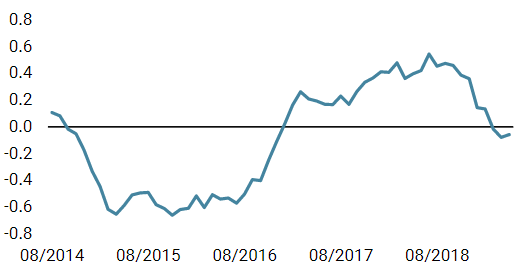

Market Stress Nowcaster

Weekly Change

- Our world Growth Nowcaster marginally decreased last week, with economic data showing softer readings in the US, Canada and China.

- Our world Inflation Nowcaster continued to rise last week, especially in the US.

- Market stress increased over the past week, especially on Friday: volatilities are higher while credit spreads widened.

Sources: Unigestion. Bloomberg, as of 3 June 2019.

Past performance is no guide to the future, the value of investments can fall as well as rise, there is no guarantee that your initial investment will be returned. Important Information Past performance is no guide to the future, the value of investments can fall as well as rise, there is no guarantee that your initial investment will be returned. This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed by recipients to any other person. This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in the investment vehicles it refers to. Please contact your professional adviser/consultant before making an investment decision. Where possible we aim to disclose the material risks pertinent to this document, and as such, these should be noted on the individual document pages. A complete list of all the applicable risks can be found in the Fund prospectus. Some of the investment strategies described or alluded to herein may be construed as high risk and not readily realisable investments, which may experience substantial and sudden losses including total loss of investment. These are not suitable for all types of investors. To the extent that this report contains statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. As such, forward looking statements should not be relied upon for future returns. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of this information. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. Rates of exchange may cause the value of investments to go up or down. An investment with Unigestion, like all investments, contains risks, including total loss for the investor. Uni-Global – Cross Asset Navigator is a compartment of the Luxembourg Uni-Global SICAV Part I, UCITS IV compliant. This compartment is currently authorised for distribution in Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Spain, UK, Sweden, and Switzerland. In Italy, this compartment can be offered only to qualified investors within the meaning of art.100 D. Leg. 58/1998. Its shares may not be offered or distributed in any country where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the prospectus which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses. Unless otherwise stated performance is shown net of fees in USD and does not include the commission and fees charged at the time of subscribing for or redeeming shares. Unigestion UK, which is authorised and regulated by the UK Financial Conduct Authority, has issued this document. Unigestion SA authorised and regulated by the Swiss FINMA. Unigestion Asset Management (France) S.A. authorised and regulated by the French Autorité des Marchés Financiers. Unigestion Asia Pte Limited authorised and regulated by the Monetary Authority of Singapore. Performance source: Unigestion, Bloomberg, Morningstar. Performance is shown on an annualised basis unless otherwise stated and is based on Uni Global – Cross Asset Navigator RA-USD net of fees with data from 15.12.2014 to 03.06.2019.Navigator Fund Performance

Performance, net of fees

2018

2017

2016

2015

Navigator (inception 15 December 2014)

-3.6%

10.6%

4.4%

-2.2%