Minimum Variance Portfolio: Choosing the Right Currency

- In a minimum variance portfolio, choosing the right currency for optimisation can have a significant impact on construction and performance.

- Our backtested analysis shows that performances of portfolios using home or USD currencies can vary. Both can be optimal depending on context and client preferences.

- We have developed a third option that achieves a trade-off between the benefits of home currency and international USD optimisation.

Overview

The low volatility (or low beta) anomaly is one of the oldest documented deviations from the capital asset pricing model, with the first description usually attributed to Fisher Black in 1972 [1]. These findings were initially received with scepticism and not exploited in the form of an investment strategy. However, since then, investors have accepted the reality of this anomaly and exploit it through a large number of strategies with significant assets.

One such strategy is investing in the Minimum Variance Portfolio (MVP), which is essentially an optimal combination of low volatility equities. One of the questions arising from this approach is the treatment of currency exposures and, in particular, the choice of the currency used for optimisation and its consequences.

In this paper, we review the different options available to investors and their consequences in terms of performance and portfolio allocation, before discussing the appropriate choice in light of each investor’s context.

Currency of Optimisation: What Are Your Options?

Currency volatility is an important part of the volatility of an equity investment. It is clearly a source of risk, but offers diversification benefits as well. As such, it is an important driver in the construction of the MVP, as detailed in [5]. Notably, the choice of the currency for optimisation in the portfolio appears to be one of the most important determinants of the strategy.

There are three options to consider in this context: the investor’s home currency, the dominant currency in the investment universe (usually USD), or considering only local currency returns.

Dominant Currency Optimisation

Using the dominant currency for portfolio optimisation seems a sensible alternative to using home currency. It is usually the recognised set-up for performance comparison purposes, and it is representative of the majority of the investor’s choices.

Usually, USD is the dominant currency, either in the context of global strategies or, by convention, in the context of emerging markets strategies.

Technically, the dominant currency is also the choice for minimising currency impacts without entering into the complexities of the local currency optimisation described in the following section.

Home Currency Optimisation

Considering total risk expressed in the investor’s home currency is theoretically the correct way to build the MVP. By definition, this is the approach that produces the lowest volatility (at least ex-ante) expressed in the investor’s home currency.

The main consequence of this approach is that instruments quoted in the home currency will appear as less risky than others, because of their lack of currency risk. This translates into an MVP with higher allocation to the home currency, effectively reflecting a form of home bias.

Local Currency Optimisation

Some studies (for example, see [7]) argue for hedging out currency exposure from the investment portfolio by using a local currency optimisation in the context of the MVP, i.e. considering the instruments’ returns in their local currency to assess the covariance matrix.

The main argument for this approach is that there is no premium associated with currency risk; hence, no such risk is worth being taken. The low volatility anomaly is notably always present, independent of whether volatility is considered in local currency terms or in a fixed currency. It is reassuring that the usual economic and behavioural explanations for the low volatility anomaly still hold in local currency terms (For example, see a recent review in [2]).

The main argument against such an approach is one of additional complexities, the costs of hedging, and the nature and magnitude of currency risk in stocks of large international businesses.

A final argument is one of asset management practice, where equity investors traditionally mostly invest in equities without hedging their foreign investments.

The main argument against local currency optimisation is the additional complexities, the costs of hedging, and the magnitude of currency risk in stocks of large international businesses.

Empirical Results

To make an informed decision regarding the currency of optimisation, we empirically tested different optimisation currencies to build theoretical MVPs. We applied a minimal set of assumptions in the optimisation to focus on the specific impact of different currencies of optimisation (see Appendix A).

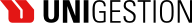

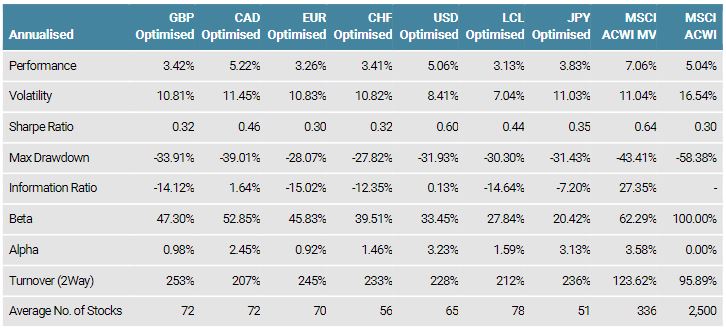

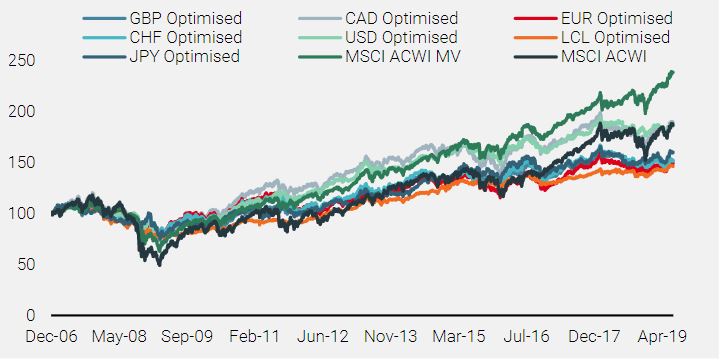

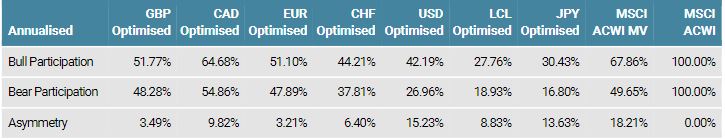

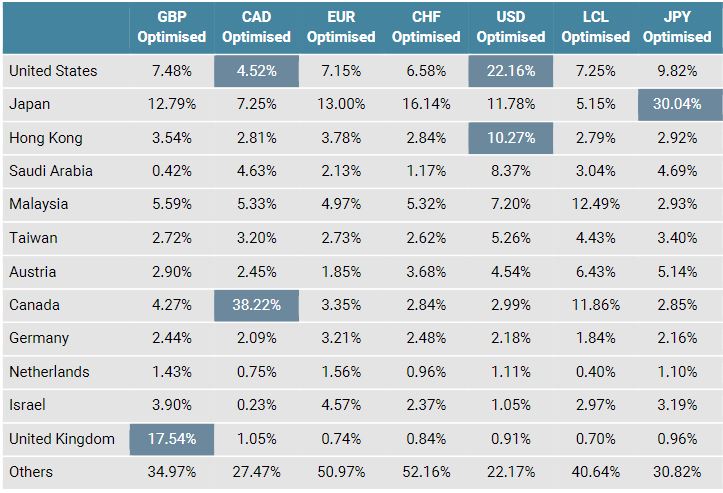

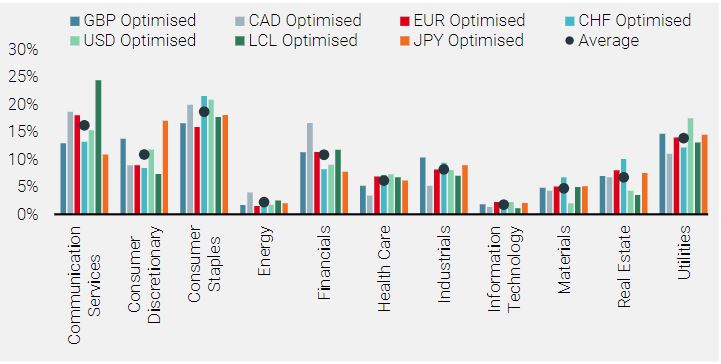

In the charts below, currencies (eg CAD) refer to the currency of optimisation. ‘LCL Optimised’ refers to the optimisation in local currency, hedged in USD. The MSCI Global (ACWI) is the reference index but we also include the MSCI Global Minimum Variance index (MSCI ACWI MV) as an additional comparator.

Figure 1: Statisitics (Annualised)

Figure 2: Historical Tracks

Figure 3: Annual Performance

The MVP in home currency is the one with the lowest realised volatility, and in every case, MVP realised volatility is lower than the reference index.

Several results are worth commenting on:

- Realised volatility is consistent with expectations: the MVP in home currency is the one with the lowest realised volatility, and in every case, MVP realised volatility is lower than the reference index.

- Realised performance varies, with outstanding results from USD-based optimisation across the board. Part of this outperformance is attributable to the US bias of these MVPs (22% in USD Optimised versus on average 7% in others), and the significant outperformance of the US market in the period under review (US performance was 116% in the period while the global performance was about 89%). While informative, this anecdotal outperformance should not be the rationale for a simplistic choice.

- Regarding allocation, portfolios that use different optimisation currencies remain quite similar in terms of sector and country allocations, with the exception of notable home biases (see Appendix B and C).

- Finally, a significant distinction must be made in home currency optimisation between defensive currencies (CHF and JPY) and more cyclical currencies such as CAD. Optimising in defensive strategies may lead to very defensive portfolios, while using cyclical currencies may detract from the dominant defensive characteristics of the MVP approach. This is visible in the level of participation in the table below. As such, home currency optimisation in the case of cyclical currencies may prove less effective.

Figure 4: Participation Ratio

Discussion: Unigestion’s View

While we recognise the theoretical efficacy of local currency optimisation, the costs and complexities associated with hedging and the uncommon nature of the approach make it impractical. Furthermore, empirically, we see no particular support for this approach in terms of risk or performance.

Beyond the performance difference between home currency and dominant currency optimisation, the main difference consists in the incorporation of some home bias in the home currency version. On the one hand, holding everything else constant, as a rule of thumb, we tend to promote home currency optimisation if the investor is looking for a global investment solution. This has two major benefits: achieving a truly MVP in the currency of evaluation, and reflecting, in a rational, risk-based way, the natural home bias of the investor.

On the other hand, if the investor is looking for an international investment solution (i.e. excluding the home bias), we would advise USD optimisation. Here, the associated benefits include the comparability of the results, as well as avoiding both over-representing the home country, and the potentially detrimental interaction between the defensive nature of the MVP approach and the potential cyclicality of the home currency.

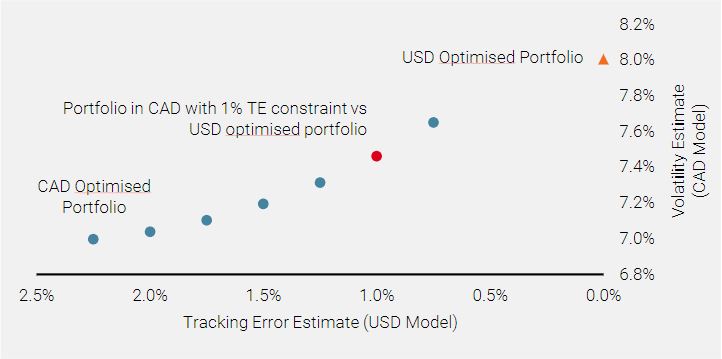

Unigestion has developed capabilities to control the home bias and achieve a trade‑off between home currency optimality and consistency with international USD optimisation.

In practice, Unigestion has developed capabilities to control the home bias and achieve a trade-off between home currency optimality on the one hand and consistency with international USD optimisation on the other. This approach consists of anchoring the home currency optimisation to the USD optimised portfolio through a tracking error budget between both portfolios. Our research indicates that the key improvements in long-term characteristics are maintained, while periods of short-term underperformance that can arise due to differing currency allocations are significantly mitigated.

Figure 5: Unigestion‘s Approach to Home-bias Control

Source: Bloomberg, Unigestion. Simulated performance is not indicative of future returns. See Appendix A for all backtest information.

The right choice should be driven mainly by client-specific context and expectations. Past performance alone should not be given too much importance.

Conclusion

Currencies and their treatment in investment strategies are always a sensitive and complex topic. Definitive solutions are elusive, and usually very specific to each investor. This problem takes centre stage in the case of the MVP portfolio, given the importance of the optimisation currency in the process.

We have shown that several solutions are available to investors, but that the right choice should be driven mainly by client-specific context and expectations. Empirical results are a helpful guide to take this decision, but past performance alone should not be given too much importance.

Finally, the majority of the dominant drivers of performance, such as styles (low volatility, quality) and sector allocation remain similar, regardless of the optimising currency. As noted in [5], overlaps between portfolios remain high as well. Consequently, the long-term expectations for the different solutions remain quite similar, and appear to be compelling investment solutions.

Appendices

Appendix A: Backtest Assumptions

- Period: 31/12/2006 to 30/06/2019

- Position threshold: 10 bps

- Max weight per stock: 5%

- GICS LI max allocation: 30%

- AUM assumption: USD 3 bn flat

- Tracks are all calculated in USD for comparison purposes.

Appendix B: Country Allocations

Appendix C: Sector Allocations

References

[1] F. Black, Capital Market Equilibrium with Restricted Borrowing, The Journal of Business, 45, 444-455 (1972)

[2] D Blitz, E. Flakenstein and P. van Vliet, Explanations for the Volatility Effect: An Overview Based on the CAPM Assumptions, working paper (2013)

[3] R. Haugen and A. Heins, Risk and the Rate of Return on Financial Assets: Some Old Wine in New Bottles, The Journal of Financial and Quantitative Analysis Vol. 10, No. 5 pp. 775-784 (1975), https://www.jstor.org/stable/2330270

[4] P. Jorion, Mean/Variance Analysis of Currency Overlays, Financial Analysts Journal, May/June (1994)

[5] A. Jourovski, Currency Impact on Minimum Variance Portfolio, Unigestion Working Paper (2011)

[6] D. Lamponi, Currency Exposure in International Minimum Variance Portfolios, Journal of Wealth Management (2016)

[7] AF. Perold, EC. Schulman, The Free Lunch In Currency Hedging: Implications For Investment Policy and Performance Standards. Financial Analysts Journal 44 (3): 45–52 May/June (1988)

[8] J. Schmittmann, Currency Hedging for International Portfolios. IMF Working Paper (2010)

[9] E. Walker, Strategic Currency Hedging and Global Portfolio Investments Upside Down, Journal of Business Research 61 657–668 (2008)

Important Information

This information is issued by Unigestion (UK) Ltd (“Unigestion”), which is authorised and regulated by the UK Financial Conduct Authority (“FCA”). Unigestion is also registered as an investment adviser with the U.S. Securities and Exchange Commission (“SEC”). This information is intended only for professional clients, institutional clients and eligible counterparties, as defined by the FCA, and qualified purchasers as defined by the SEC and has therefore not been adapted to retail clients.

It must not be published, reproduced, distributed or disclosed (in whole or in part) by recipients to any other person without the prior consent of Unigestion. The information provided should only be considered current as of the date of publication without regard to the date on which you may access the information. Unigestion maintains the right to delete or modify information without prior notice. This presentation is a promotional statement of our investment philosophy and services and does not constitute an offer or solicitation to acquire, sell or subscribe to any securities or financial instruments described or alluded to herein which may be construed as high risk and not readily realisable investments and may experience substantial and sudden loss including total loss of investment. The securities mentioned in this document may not be authorised for public distribution in certain jurisdictions and are not offered or distributed on a public basis in or from any country where such distribution would be prohibited by law. The investments described herein are not suitable for all types of investors. All investors must obtain additional information needed to evaluate a potential investment and provide important disclosures regarding risks, fees and expenses. Investors shall in particular conduct their own analysis of the risks (including any legal, regulatory, tax or other consequence) associated with an investment and should seek independent professional advice.

No separate verification has been made as to the accuracy or completeness of the data included in this presentation, which may have been derived from third party sources, such as fund managers, administrators, custodians and other third party sources. As a result, no representation or warranty, express or implied, is or will be made by Unigestion as regards the information contained herein and no responsibility or liability will be accepted.

The performance figures are based on estimated fees and expenses as well as on the underlying strategy’s estimated performances given by fund managers, administrators, custodians and third party sources at a given date. Past performance is neither guaranteed nor a reliable indicator of future results. The value of investments may go down or up. Where performance is reflected gross of fees, potential investors should be aware that the inclusion of fees, costs and charges will reduce the overall value of performance. An investment with Unigestion, like all investments, contains risks, including the risk of total loss. Unless otherwise stated, the performance data source is Unigestion.

This information is provided to you solely to give you background information relating to Unigestion, certain strategies it implements and currently offers. Before making an investment decision with respect to the strategy discussed herein, potential investors are advised to consult with their tax, legal, ERISA and financial advisors. Note that not all strategies may be available or suitable for investment by U.S. investors.

This document does not purport to be complete and is qualified in its entirety by reference to the more detailed discussions relating to the strategies mentioned. Unigestion has the ability in its sole discretion to change the strategies described herein.

This document is being provided to you on a confidential basis solely to assist you in deciding whether or not to proceed with a further investigation of a strategy or Unigestion. Accordingly, this document may not be reproduced in whole or part, and may not be delivered to any person without the consent of Unigestion.

Nothing set forth herein shall constitute an offer to sell any securities or constitute a solicitation of an offer to purchase any securities. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Such formal offering documents contain additional information not set forth herein, which such additional information is material to any decision to invest in a strategy.

No information is warranted by Unigestion or its affiliates or subsidiaries as to completeness or accuracy, express or implied, and is subject to change without notice. This document contains forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect Unigestion’s views as of such date with respect to possible future events. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond a strategy’s or Unigestion’s control. Readers are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward-looking statements in this document.

These materials should only be considered current as of the date of publication without regard to the date on which you may receive or access the information. Unigestion maintains the right to delete or modify information without prior notice.

Charts, tables and graphs contained in this document are not intended to be used to assist the reader in determining which securities to buy or sell or when to buy or sell securities.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

The past performance of Unigestion, its principals, shareholders, or employees is not indicative of future returns.

Except where otherwise specifically noted, the information contained herein, including performance data and assets under management, relates to the entire affiliated group of Unigestion entities over time including that of Unigestion UK. Such information is intended to provide the reader with background regarding the services, investment strategies and personnel of the Unigestion entities. No guarantee is made that all or any of the individuals involved in generating the performance on behalf the other Unigestion entities will be involved in managing any client account on behalf of Unigestion U.K. More specific information regarding Unigestion UK is set forth herein where indicated and is available on request.

There is no guarantee that Unigestion will be successful in achieving any investment objectives. An investment strategy contains risks, including the risk of complete loss.

The risk management practices and methods described herein are for illustrative purposes only and are subject to modification.

Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of this information. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. Unless otherwise stated, sources are Unigestion, Bloomberg and Compustat.

For US investors, Unigestion is relying on SEC Rule 15a-6 under the Securities Exchange Act of 1934 regarding exemptions from broker-dealer registration for foreign broker dealers. Foreside Global Services, LLC is acting as the chaperoning broker dealer for Unigestion for the purposes of soliciting and effecting transactions with or for U.S. institutional investors or major U.S. institutional investors.

Backtested or simulated performance is not an indicator of future actual results. The results reflect performance of a strategy not currently offered to any investor and do not represent returns that any investor actually attained. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. See Appendix A above for all backtest assumptions.

Changes in these assumptions may have a material impact on the backtested returns presented. Certain assumptions have been made for modeling purposes and are unlikely to be realized. No representations and warranties are made as to the reasonableness of the assumptions. This information is provided for illustrative purposes only. Backtested performance is developed with the benefit of hindsight and has inherent limitations. Specifically, backtested results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Further, backtesting allows the security selection methodology to be adjusted until past returns are maximized. Actual performance may differ significantly from backtested performance.