Private Equity Market Insights

-

Private equity capital raising continued to increase in the third quarter, despite slower investment and exit activity.

-

The development of new types of specialised transactions, such as GP-led fund restructurings, is transforming the secondary market.

-

Demand for innovative new sources of liquidity from both LPs and GPs is likely to fuel continued growth in the secondary market, irrespective of broader market trends.

Overview

Continuing the downward trend seen in the first half of 2019, global investment activity in the private equity market was again lower in Q3 compared to the same quarter a year ago. Similarly, after a strong second quarter, global exit activity recorded a sharp fall in Q3. However, investors in private equity funds are seemingly unperturbed by market events. Fundraising recorded its largest third quarter total in the last five years, with the large end of the market particularly strong.

Investment and Exits Down, Fundraising Up

The global aggregate value of private equity deals closed during the first three quarters of 2019 was USD 269bn, 25% down on the same period last year1. While contributions by region show volatility by quarter, the overall downward trend is similar across North America, Europe and Asia.

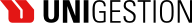

The same story is being told by global exit activity. Despite the high level of exit activity in Q2, the global aggregate value of exits for the first three quarters of 2019 was USD 256bn, 27% down on the same period last year2. The biggest contributor to this fall was IPO volume, which was almost 40% lower.

Nevertheless, this global slowdown in investment and exit activity is clearly not putting investors off. The third quarter showed another uptick in aggregate capital raised by private equity funds, pushing up year-to-date fundraising to USD 417bn3. This is 21% ahead of the amount raised in the same period a year ago. As a result, dry powder inched up higher to USD 740bn.

Figure 1: Value (USD bn) and Number of Exits

The large end of the market continues to dominate the headlines. In the third quarter, firms such as Permira (EUR 11bn) and, in particular, Blackstone (USD 26bn), raised record-breaking funds. Notably, of the private equity firms currently fundraising, only 13% are targeting fund sizes of USD 500m or more, yet this represents more than two thirds of the aggregate capital being targeted4. Thus, the vast majority of private equity firms on the road are the lesser-known, small buyout fund managers.

While the large end of the market continues to dominate the headlines, the majority of private equity firms on the road are small buyout fund managers.

Similarly, while newspapers may find more interest in stories such as the GBP 4bn take-private of UK aerospace and defence supplier Cobham by Advent at 15x EBITDA, the numerous deals at the small end of the market give a more interesting indicator of what is happening in the “real” economy. For example, in May 2019, one of our fund managers acquired an Italian aluminium extrusion die manufacturer for EUR 170m or 8x EBITDA. The company employs 700 people at its headquarters in Italy and sells its technologically advanced products to over 250 customers worldwide in the transportation and construction sectors.

The Evolution of the Secondary Market

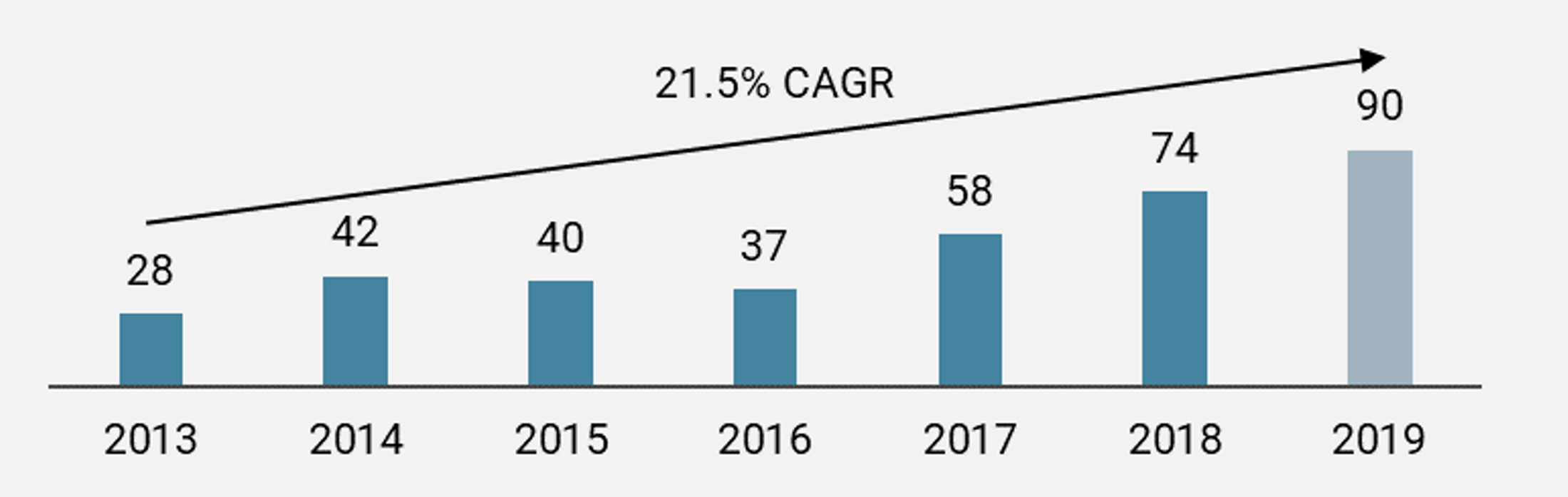

While overall private equity investment activity has been somewhat subdued in 2019, secondary investment activity is on course for a record year. In fact, the secondary market has grown at a CAGR of 21.5% since 2013, more than trebling in that time. This fast-paced growth has raised concern amongst investors that the market is becoming overheated.

Figure 2: Secondary Transaction Volume (USD bn)

On the one hand, average secondary prices have been hovering close to 100% of NAV, suggesting that the discount traditionally expected by secondary buyers has all but evaporated. On the other hand, the secondary market has transformed in recent years with the development of a range of new types of specialised secondary transactions.

GPs have increasingly been utilising the secondary market as a proactive fund management tool.

The rise of GP-led transactions

Up until around 2012, close to 100% of secondary deals completed were traditional acquisitions of limited partner (LP) stakes in private equity funds where the general partner (GP) had little involvement. In 2018, almost a third of all secondary transactions were “GP-led”. In other words, GPs have increasingly been utilising the secondary market as a proactive fund management tool.

The most common GP-led transaction is a fund restructuring, whereby a GP sets up a new “continuation fund” in which it transfers some or all of its portfolio companies from a maturing fund. By doing this, LPs have the choice to roll over their investment into the new fund or exit via the capital from incoming secondary investors.

In theory, this can be a win-win for all parties involved. LPs have the option to get early liquidity at a fair price set by the market. Secondary investors are able to get exposure to potentially attractive, mature assets. Meanwhile, the GP can obtain more time to maximise the value of its portfolio and thus maximise its carried interest payout, especially since it will have reset its incentives in the continuation fund.

In practice, it is never so simple. For example, there are certain conflicts of interest that both LPs and secondary investors need to navigate carefully. When a GP transfers one or more portfolio companies into a continuation fund, carried interest in the mature fund will typically be generated. Secondary investors will often insist that the GP invests most of its crystallised carried interest into the continuation fund in order to maintain a decent alignment of incentives.

There is also the question of which portfolio companies should be transferred to the continuation fund. While both secondary investors and the GP may want to focus only on the most attractive companies, certain LPs might prefer that the entire fund is transferred and thus liquidated.

Secondaries at Unigestion

At Unigestion, we have participated in multiple fund restructurings in the last five years as both an incoming secondary investor as well as an incumbent LP. As a secondary investor, one of the key advantages is that it is possible to do very detailed due diligence on each of the underlying portfolio companies with the full support of the GP. This entails meeting management teams, taking key references and running financial models – the same level of diligence that would be typically done for a direct investment.

At Unigestion, we have participated in multiple fund restructurings in the last five years, gaining access to high quality portfolios at attractive discounts.

In early 2019, Unigestion co-led a secondary transaction consisting of six mature portfolio companies which were hand-picked from three different funds managed by Televenture, a Nordic technology investor. The GP had previously attempted to execute a full restructuring of all three funds (consisting of 22 companies) but this failed due to disappointing pricing. This gave us the opportunity to approach the GP with a more tailored liquidity solution.

This was a complex transaction which required multiple due diligence sessions with the GP and the company management, as well as careful negotiation with the original LPs. However, we ultimately gained access to a high quality portfolio of fast-growing companies at an attractive 18% discount to NAV. After less than 12 months, two companies are already in the process of being sold at an attractive mark up to our entry cost.

We believe that the secondary market will continue to grow, fuelled by the desire of both LPs and GPs to gain liquidity utilising increasingly innovative methods, especially when overall private equity exit activity is trending downwards. By the end of 2018, the total assets under management in the private equity market was over USD 4tn5. Thus, at USD 90bn, the secondary market is still only scratching the surface.

1, 2, 3, 4, 5 Preqin

Important Information

Past performance is no guide to the future, the value of investments, and the income from them change frequently, may fall as well as rise, there is no guarantee that your initial investment will be returned. This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed by recipients to any other person. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in the investment vehicles to which it refers. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Please contact your professional adviser/consultant before making an investment decision.

Where possible we aim to disclose the material risks pertinent to this document, and as such these should be noted on the individual document pages. The views expressed in this document do not purport to be a complete description of the securities, markets and developments referred to in it. Reference to specific securities should not be considered a recommendation to buy or sell. Investors shall conduct their own analysis of the risks (including any legal, regulatory, tax or other consequences) associated with an investment and should seek independent professional advice. Some of the investment strategies described or alluded to herein may be construed as high risk and not readily realisable investments, which may experience substantial and sudden losses including total loss of investment. These are not suitable for all types of investors.

To the extent that this report contains statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. Actual results could differ materially from those in the forward-looking statements. As such, forward looking statements should not be relied upon for future returns. Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of this information. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. Rates of exchange may cause the value of investments to go up or down. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

Unigestion (UK) Ltd. is authorised and regulated by the UK Financial Conduct Authority (FCA) and is registered with the Securities and Exchange Commission (SEC). Unigestion Asset Management (France) S.A. is authorised and regulated by the French “Autorité des Marchés Financiers” (AMF). Unigestion Asset Management (Canada) Inc., with offices in Toronto and Montreal, is registered as a portfolio manager and/or exempt market dealer in nine provinces across Canada and also as an investment fund manager in Ontario and Quebec. Its principal regulator is the Ontario Securities Commission. Unigestion Asia Pte Limited is authorised and regulated by the Monetary Authority of Singapore. Unigestion Asset Management (Copenhagen) is co-regulated by the “Autorité des Marchés Financiers” (AMF) and the “Danish Financial Supervisory Authority” (DFSA). Unigestion Asset Management (Düsseldorf) SA is co-regulated by the “Autorité des Marchés Financiers” (AMF) and the “Bundesanstalt für Finanzdienstleistungsaufsicht” (BAFIN). Unigestion SA has an international advisor exemption in Quebec, Saskatchewan and Ontario. Unigestion SA is authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA). Unigestion SA’s assets are situated outside of Canada and, as such, there may be difficulty enforcing legal rights against Unigestion SA.