From the outset, US President Trump has been clear that increasing economic and corporate wealth is his top priority. During his presidency, he has consistently used the stock market to measure the success of his actions and policies. But what if we look at corporate earnings, the nexus of everything from trade to fiscal to regulatory reform? After enjoying a big increase in earnings due to the tax overhaul, corporates have seen their earnings deteriorate sharply. Analysts believe that this is only temporary, the trough is near and future earnings growth will improve. However, dividends in the S&P 500 reveal a different picture, implying anaemic earnings growth for the coming years. “Something’s gotta give!” Since Donald Trump took office, annual S&P 500 profits have grown at twice their historical growth rate. Obviously, any discussion of the president’s impact on profits begins with the corporate tax overhaul. Booked profits exceeded analyst predictions by almost 8% in 2018. However, upside surprises of this magnitude are rare and tough to repeat, and earnings growth forecasts are back to the usual pattern – deteriorating over time. This year, analysts have heavily downgraded earnings, leading to a forecast of a 3.2% decline for the third quarter (Q3) year-on-year. Given the historic trend that many companies’ earnings surpass estimates, we believe that we could end the quarter in slightly positive territory. But even if we get marginally positive earnings this quarter, the trend has clearly changed since the tax overhaul. With earnings-per-share growth stalling, market performance depends on low rates more than ever. Or, said differently, President Trump publicly speaks disparagingly about Fed Chairman Jerome Powell – and then takes the credit for his efforts. In Q2, year-on-year earnings growth was the weakest since the 2015-2016 earnings recession. Excluding buyback benefits, the S&P 500 posted the first quarterly year-on-year decline (-0.6%) in three years. The tone during the earnings calls was very cautious, suggesting very low levels of optimism, the lowest since Q2 2003. One in five companies in the S&P 500 mentioned negative impacts from the tariffs and trade dispute. Uncertainty about the economy and the trade situation has led to postponement in big investments in buildings and equipment. Consequently, we expect that the negative earnings surprises in Q3 will mostly come from sectors with high exposure to global trade and those with high international revenue exposure due to the strong US dollar. Last week, the Q3 earnings season kicked off with an encouraging rate of earnings beats. Across the S&P 500, these first few days of results have shown actual earnings coming in 3.7% ahead of estimates on average. Over the next two weeks, companies representing two thirds of the S&P 500 market capitalisation will report. Their guidance will give us a good indication if the trough in earnings is behind us and if the very high earnings growth expectations from the analysts for 2020 (+10.6%) and 2021 (+9%) are realistic. Dividends tend to be far less volatile year-on-year than respective share prices, although both are influenced by the capacity of a firm to generate earnings. Companies normally manage shareholder expectations using long-term dividend payout targets, but they can also try to maximise shareholder satisfaction by deciding to temporarily deviate from its policy. Shareholders often use dividend payments as the main indicator of a company’s health and of management’s performance. Therefore, companies are more likely to increase payouts when earnings fall than they are to decrease payouts when earnings rebound, creating a convexity in dividend payments versus earnings. In 1982, the SEC adopted a new rule that provided companies with a safe haven against charges of market manipulation when repurchasing their own shares. That regulation made dividends even more stable as buybacks could now be used as dividends that offer management teams greater flexibility to increase and decrease the amount of cash returned to shareholders. In the current context where uncertainties are high and global growth low, companies tend to postpone their capital expenditures and return capital to investors via more flexible buyback operations. This, combined with very cheap financing (interest rates and credit spreads), has resulted in US corporates being the largest net buyers of US equities over the last decade, repurchasing more than USD 5tn since the financial crisis. In 2018, the payout ratio equaled 88% of earnings with about two thirds coming from buybacks and one third from dividends. A 50% share repurchase increase to an all-time high of over USD 800bn in the same year triggered a big public debate about the use of corporate cash in Washington and beyond. In contrast, dividends no longer seem to attract attention despite a steady average annual rise of 7% over the past decade. In contrast to the much more upbeat earnings expectations, the dividend market is pricing in an anaemic 0.7% annual growth over the next decade. To put that number into perspective, the S&P 500 dividend-per-share growth has never averaged below 2.2% in any 10-year period since 1950. Moreover, dividend markets have been much more resilient during recessions. During the last 11 downturns (since 1947), dividends declined by a median of 5% from peak to trough and have taken a median of five quarters to recover to pre-recession peaks. Clearly, S&P 500 dividends and the underlying spot market tell two different stories. Therefore, we see an attractive relative value opportunity in buying dividend futures and selling S&P 500 futures (beta hedged) against it. Due to heavy underperformance recently, dividends have significant catch-up potential if the black cloud of uncertainty dissipates. In the case of a recession, the magnitude of the dividend decline should show little correlation to the magnitude of the decline in earnings. With buybacks providing an extra layer of protection, dividends should benefit from their stability.“Something’s Gotta Give” – Johnny Mercer, 1954

What’s Next?

Are the Headwinds Fading?…

…The Dividend Market is not Convinced

The Future Will Show Who Has Been Right

Our proprietary nowcasters currently show a low risk of recession and very low risk of inflation surprise, offering a good environment for carry strategies. In this context, dividends offer a very compelling risk-reward. We believe that the relatively positive developments on the political front and the stabilisation in macro data are not well priced in the market. Negative sentiment and high uncertainty have led to a light positioning in risky assets. Cyclical assets look fairly valued compared to very expensive hedging assets. A small positive sentiment change could trigger a pain trade on the upside.Asset Allocation: The Pain Trade is to the Upside

Something’s Gotta Give

Our medium-term view is currently more constructive, as we are still overweight growth assets and underweight real assets. Given the current cost of hedging, we are using forex-based strategies exposures to hedge ourselves against adverse market conditions. Over the month of October, the Multi Asset Risk Targeted Strategy lost -0.7% versus 0.9% for the MSCI AC World Index and –0.5% for the Barclays Global Aggregate (USD hedged). Year-to-date, the Multi Asset Risk Targeted Strategy has returned 9.4% versus 17.3% for the MSCI AC World index, while the Barclays Global Aggregate (USD hedged) index is up 8.2%. * The Multi Asset Risk Targeted Strategy performance is shown in USD net of fees for the representative account of the Multi Asset Risk Targeted (Medium) USD Composite and reflects the deduction of advisory fees and brokerage commission and the reinvestment of all dividends and earnings. Past performance is not indicative of future performance. This information is presented as supplemental information only and complements the GIPS compliant presentation provided on the following page.Strategy Behaviour

Performance Review

Unigestion Nowcasting

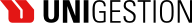

World Growth Nowcaster

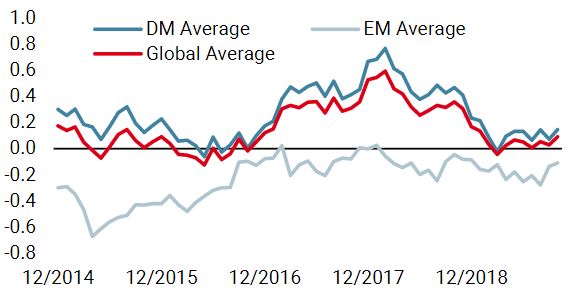

World Inflation Nowcaster

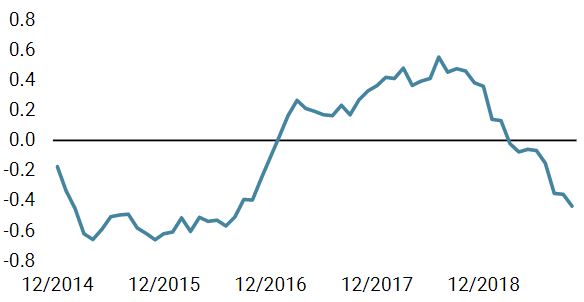

Market Stress Nowcaster

Weekly Change

- Our world Growth Nowcaster modestly increased last week, driven by broad-based improvement in data.

- Our world Inflation Nowcaster rose marginally over the last week, driven by US and UK data.

- Market stress also increased slightly over the week, driven largely by liquidity conditions.

Sources: Unigestion. Bloomberg, as of 21 October 2019.

Important Information

Past performance is no guide to the future, the value of investments can fall as well as rise, there is no guarantee that your initial investment will be returned. This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed by recipients to any other person. This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in the investment vehicles it refers to. Please contact your professional adviser/consultant before making an investment decision. Where possible we aim to disclose the material risks pertinent to this document, and as such these should be noted on the individual document pages. Please contact Unigestion for a complete list of all the applicable risks. Some of the investment strategies described or alluded to herein may be construed as high risk and not readily realisable investments, which may experience substantial and sudden losses including total loss of investment. These are not suitable for all types of investors. To the extent that this report contains statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. As such, forward looking statements should not be relied upon for future returns. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of this information. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. Rates of exchange may cause the value of investments to go up or down. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

This information is issued by Unigestion (UK) Ltd (“Unigestion”), which is authorised and regulated by the UK Financial Conduct Authority (“FCA”). Unigestion is also registered as an investment adviser with the U.S. Securities and Exchange Commission (“SEC”). This information is intended only for professional clients, institutional clients and eligible counterparties, as defined by the FCA, and qualified purchasers as defined by the SEC and has therefore not been adapted to retail clients.

Unigestion Multi Asset Risk-Targeted (USD): 31 December 2014 to 30 June 2019

| Year | Composite Return Gross of Fees |

Composite Net Return | Benchmark Return | Number of Accounts | Internal Dispersion | Composite 3-Yr Std Dev | Benchmark 3-Yr Std Dev | Composite AUM (M) | Firm AUM (M) |

| 2015 | -1.61% | -2.80% | – | 1 | – | – | – | 127.24 | 15,550.31 |

| 2016 | 5.05% | 3.79% | – | 1 | – | – | – | 129.66 | 18,144.46 |

| 2017 | 11.16% | 9.82% | – | 1 | – | – | – | 169.51 | 22,340.80 |

| 2018 | -2.91% | -4.08% | – | 1 | – | – | – | 286.93 | 21,403.49 |

| 20191 | 7.45% | 6.80% | – | 1 | – | – | – | 364.46 | 21,692.55 |

1: This year is incomplete, it stops in June.

Special Disclosure: For presentations prior to 31.03.2018 the strategy was measured against the LIBOR 3M USD + 4%. Beginning April 2018 the firm determined that the benchmark did not accurately reflect the strategy mandate and the benchmark was removed. Definition of the Firm: For the purposes of applying the GIPS Standards, the firm is defined as Unigestion. Unigestion is responsible for managing assets on the behalf of institutional investors. Unigestion invests in several strategies for institutional clients: Equities, Hedge Funds, Private Assets and the solutions designed for the clients of our Cross Asset Solution department. The GIPS firm definition excludes the Fixed Income Strategy Funds, which started in January 2001 and closed in April 2008, and the accounts managed for private clients. Unigestion defines the private clients as High Net Worth Families and Individual investors. Policies: Unigestion policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. Composite Description: The Multi Risk Targeted (Medium) composite was defined on 15 December 2014. It consists of accounts which aim to deliver consistent smooth returns of cash + 5% gross of fees across all market conditions over a 3-year rolling period. It seeks to achieve this by capturing the upside during bull markets while protecting capital during market downturns. Benchmark: Because the composites strategy is absolute return and investments are permitted in all asset classes, no benchmark can reflect this strategy accurately. Fees: Returns are presented gross of management fees, administrative fees but net of all trading costs and withholding taxes. The maximum management fee schedule is 1.2% per annum. Net returns are net of model fees and are derived by deducting the highest applicable fee rate in effect for the respective time period from the gross returns each month. List of Composites: A list of all composite descriptions is available upon request. Minimum Account Size: The minimum account size for this composite is 5’000’000.- USD. Valuation: Valuations are computed in US dollars (USD). Performance results are reported in US dollars (USD). Internal Dispersion & 3YR Standard Deviation: The annual composite dispersion presented is an asset-weighted standard deviation calculated for the accounts in the composite the entire year. When internal dispersion is not presented it is as a result of an insufficient number of portfolios in the composite for the entire year. When the 3 Year Standard Deviation is not presented it is as a result of an insufficient period of time. Compliance Statement Unigestion claims compliance with the Global Investment Performance Standards(GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Unigestion has been independently verified for the periods 1 January 2003 to 31 December 2016. The verification report(s) is/are available upon request. Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and(2) the firms policies and procedures are designed to calculate and present performance in compliance with the GIPS standards. Verification does not ensure the accuracy of any specific composite presentation.