- Equities

- Papers

- Perspectives

Edward Gladwyn

Portfolio Manager

Equities

- Central bank narrative and market positioning anticipates rate cuts

- Defensive sectors have strong economic and empirical drivers of interest rate sensitivity

- Rate cutting cycles and economic uncertainty should be beneficial for defensive sectors.

- Equity markets tend to anticipate bond markets. As such, positioning in defensive strategies before each rate cut is likely superior to waiting for them to arrive.

Overview

The covid crisis prompted a period of close-to-zero interest rates around the world, and an injection of significant monetary and fiscal stimulus. This extensive support, however, proved a doubled-edged sword as while such support was essential, it combined with trade frictions to bring about a sharp surge in inflation. This was initially expected to be transitory but policy makers soon realised that severe action would be required to prevent an inflation/price spiral. Central banks around the world then began a co-ordinated hiking cycle.

Over the subsequent two years, the Fed hiked rates 11 times – the fastest and largest (in terms of magnitude) hiking cycle ever, and others around the world followed suit.

Where do we stand today? If we look at the previous five hiking cycles in the US since 1990, the Fed paused for an average of 10 months between its last hike and its first cut. This time it has been over a year, with the last rate change being on 0.25% increase on 26 July 2023. With the last hike well in the rearview mirror and rate cuts in other markets, including the UK and Europe, understanding the market environment during cutting cycles is now critical.

Our goal is not to nail the exact scope or timing for rate cuts but to extrapolate out the likely path ahead. Historically, the lagged impact of monetary policy has lasted anywhere from 12 months to 24 months before visibly beginning to impact the economy. We are seeing some signs of stress in the labour market and this tends to be a good predictor (albeit early) of policy directionality in the coming months. Paired with central bank communcations, fixed income markets are already beginning to react, pricing in an imminent US cutting cycle.

To understand the prospects for risk managed investing, we consider the relationship between interest rates and equity sectors. These reveal both structural and transitory sensitives. These structural sensitivities – combined with the typical macroeconomic context associated with rate cutting cycles – provide dual tailwinds for the risk managed style.

Interest rate sensitivity sectors: structure and sentiment

Before considering the prospects for risk managed investing during a cutting cycle, it is worth spending some time highlighting the historical relationship between sectors and rates. This relationship has both structural and sentiment-driven aspects.

We start by ranking the most interest rate sensitive sectors over the last 20 years. This reveals the extent to which the excess return of a given sector benefits from the movement in bonds.

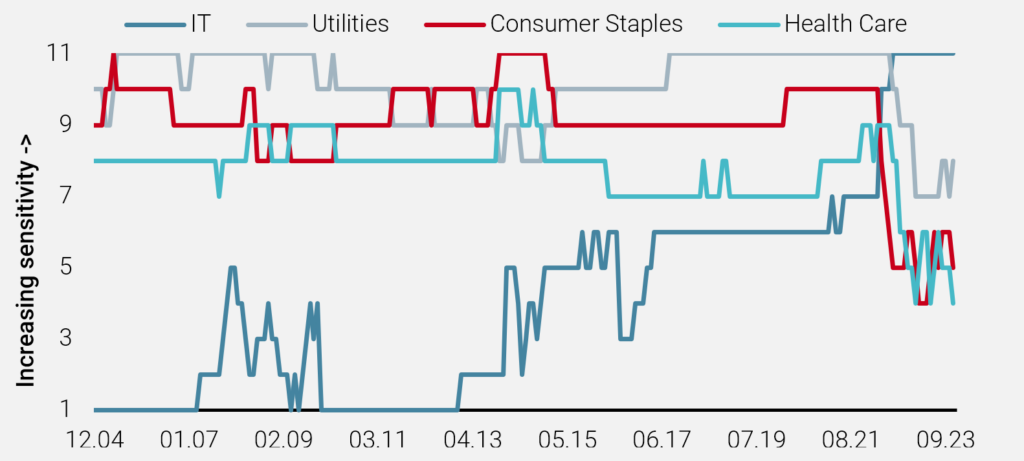

Figure 1: Excess return sensitivity to interest rates (10Y,US) rank

Source: MSCI, Bloomberg, Unigestion Calculations

Over the greater part of the period – until the most recent hiking cycle – there has been a clear hierarchy of sectors in terms of interest rate sensitivity. In Figure 1 we have highlighted the most significant and persistent, with Utilities, Consumer Staples and Health Care benefiting from falling rates throughout the period. By contrast, we see a rapid increase in sensitivity between IT and interest rates during the most recent hiking cycle.

What drives the sensitivity of Utilities, Consumer Staples and Health Care? Considering more closely their business models, we can see they share three key dynamics: capital intensity; long-date revenues; and moderately cyclical demand. Each of these builds a clear bridge to interest rates:

- capital intensity requires borrowing and a payback period;

- long-dated revenues mean the discounted values are sensitive to change in long-term rates;

- moderately cyclical demand reduces earnings uncertainty, making cash-flows more bond like without the volatility of the risk premium associated with

growth companies.

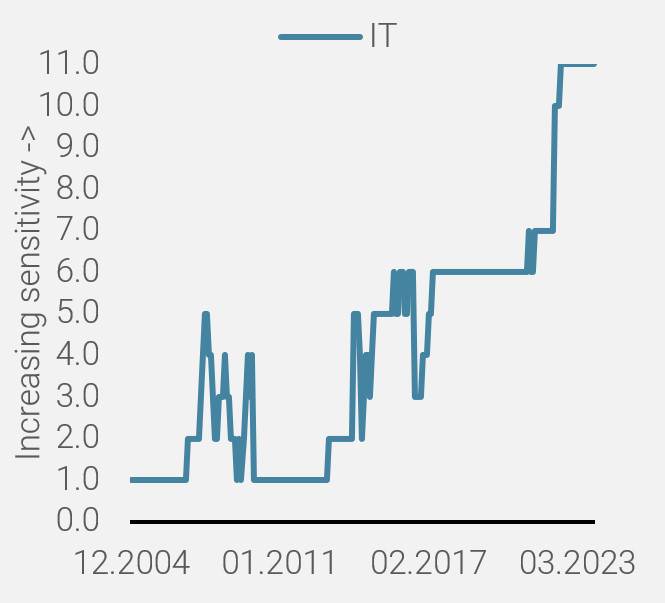

The case for IT is broadly weaker. While we have seen elements of the IT sector become more utility-like in nature – for example, cloud computing services – it hardly dominates the economic sensitivity of the sector overall.

Sentiment and the dynamic market relationship with rates

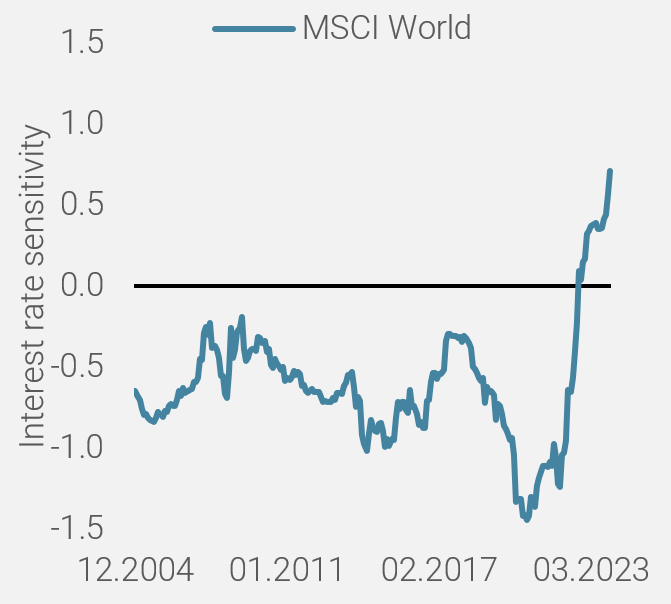

If the changing sensitivity is not structural, then perhaps it is sentiment. In Figure 2 we show the long-term relationship between the overall market and interest rates.

Figure 2: Sensitivity to bond prices (10Y, US)

Source: MSCI, Bloomberg, Unigestion Calculations

Figure 3: Excess return sensitivity to interest rates (10Y, US) rank

Source: MSCI, Bloomberg, Unigestion Calculations

Historically, falling bond prices would typically be supportive for markets and indeed the latest hiking cycle has seen markets rise. Following the final hike of 2023, this relationship has inverted. This change in relationship is reflected in the increasing IT sensitivity noted earlier. It will be a familiar pattern for those following the market day-to-day in recent months. Macroeconomic releases that indicate the Fed will consider cutting receive positive reactions from the market; the anticipation of a rate cut drives sentiment, rather than the actual consequences or context of that rate cut on the economy.

From rate sensitivity to defensiveness

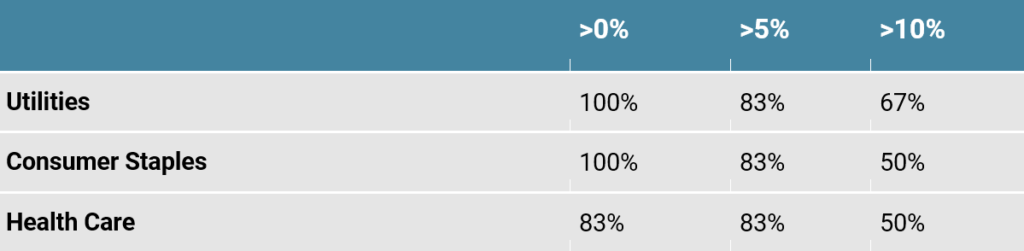

Focusing on the sectors with a structural sensitivity to interest rates, we can see they share another characteristic outside their economic drivers: defensive performance. Using a simple definition of a defensive sector – outperforming during downturns on a regular basis – we see the hit rates of these three sectors are very high.

Scenario analysis: cutting because you have to, versus managing a soft landing

In the US at least, expectations of interest rates cuts have broadly been taken as a potential positive catalyst for equity markets – fuel for an already healthy fire. We see evidence for this in equity market valuations, especially in large caps.

Historically, however, they have typically acted in the opposite fashion – with central banks being regarded as seeking to revive an economy that has been pushed into slowdown. Indeed, if history is to repeat, central banks tend to cut rates when they have to and not when they choose to.

While lower rates can be a boon for growth (given the impact on the discount rate) vs value, this impact can be lagged and the transmission effect is far weaker than for defensive sectors.

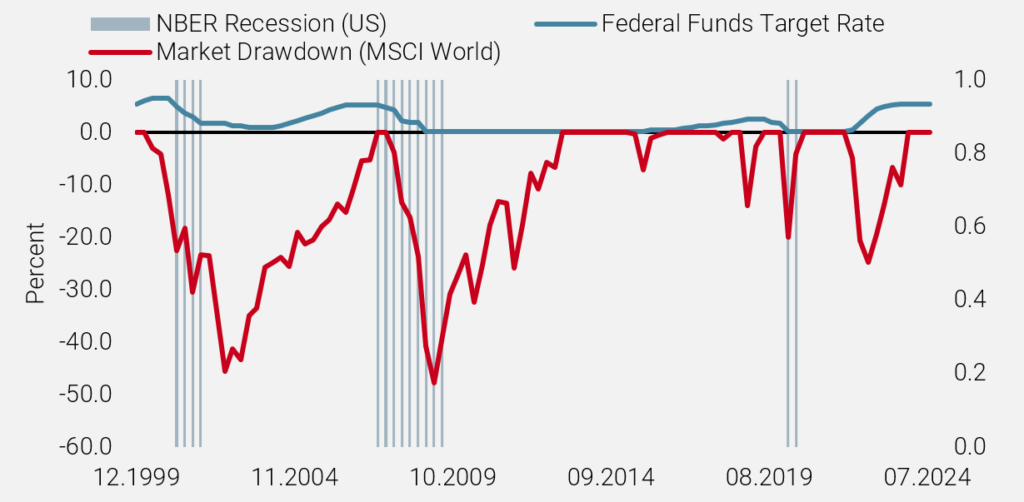

Figure 4: Cutting cycle timing compared with recession and market drawdowns

Source: MSCI, Bloomberg, Unigestion Calculations

There are two potential supporting factors for defensive sectors on a relative basis: the context in which central banks tend to cut (economic weakness) and the strong linkage between the economics of defensive sectors and interest rates. These effects are clearly additive: underlying fundamental drivers that give rise to interest rate sensitivity should dominate in a cutting environment that reflects economic slowdown.

Who moves first?

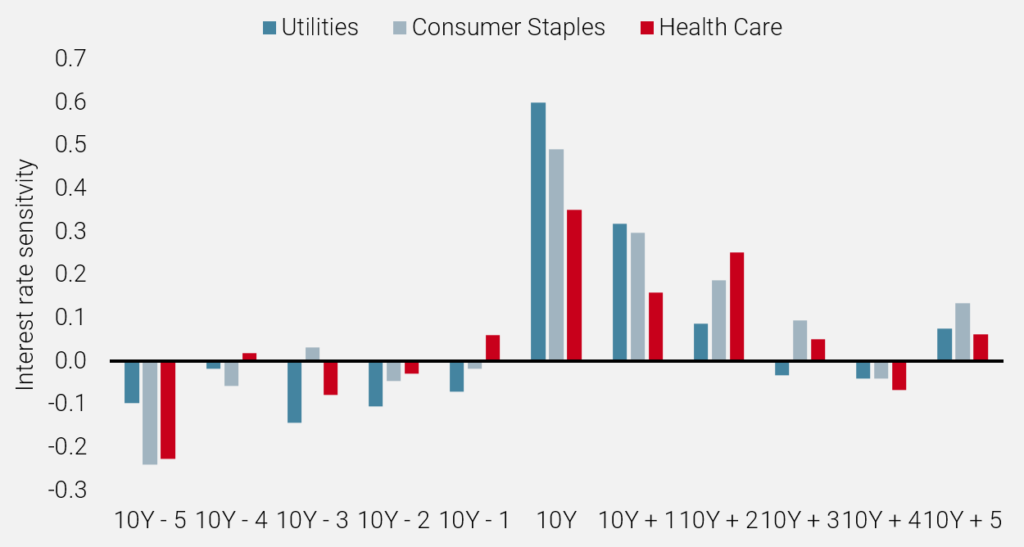

Equity markets are understood to be a discounting mechanism for future expected movements. We see this in the relationship between defensive sectors and interest rates. Figure 5 shows the sensitivity of defensive sectors to current (‘10Y’) future (‘10Y + x’) and past (’10 Y – x’) interest rates moves.

Figure 5: Past, Current and Future excess return sensitivity to interest rate moves (10Y, US)

Source: MSCI, Bloomberg, Unigestion Calculations

While the strongest relationship is coincident, outperformance of the defensive sectors anticipates movements in interest rates up to a quarter ahead of the actual movement. It is thus beneficial to be positioned for a souring in the economic environment and associated interest rate cuts.

- Central bank narrative and market positioning anticipates rate cuts even as inflation remains sticky above target

- Defensive sectors have strong economic and empirical drivers of interest rate sensitivity, while other sectors, notably IT, exhibit only transitory sensitivity. As interest rates leave the formation of market sentiment, we expect structural factors to dominate.

- Absent the global economy ‘threading the needle’ between taming inflation and economic growth, rate cutting cycles and economic uncertainty should be beneficial for defensive sectors. The strength of this tailwind will be dictated by wider macroeconomic strength or weakness.

- Equity markets tend to anticipate bond markets. As such, positioning in defensive strategies before rate cuts is likely superior to waiting for them to arrive.

Important information

INFORMATION ONLY FOR YOU

This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person without the prior written consent of Unigestion. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

RELIANCE ON UNIGESTION

There is no guarantee that Unigestion will be successful in achieving any investment objectives. An investment strategy contains risks, including the risk of complete loss.

Except where otherwise specifically noted, the information contained herein, including performance data and assets under management, relates to the entire affiliated group of Unigestion entities over time. Such information is intended to provide you with background regarding the services, investment strategies and personnel of the Unigestion entities. No guarantee is made that all or any of the individuals involved in generating the performance on behalf of one or more Unigestion entities will be involved in managing any specific client account on behalf of another Unigestion entity.

NOT A RECOMMENDATION OR OFFER

This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in either the investment vehicles to which it refers or to any securities or financial instruments described herein. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Such documentation contains additional information material to any decision to invest. Please contact your professional adviser/consultant before making an investment decision.

Reference to specific securities should not be construed as a recommendation to buy or sell such securities and is included for illustration purposes only.

RISKS

Where possible we aim to disclose the material risks pertinent to this document. The views expressed in this document do not purport to be a complete description of the securities, markets and developments referred to in it. Unigestion maintains the right to delete or modify information without prior notice. The risk management practices and methods described herein are for illustrative purposes only and are subject to modification.

Investors shall conduct their own analysis of the risks (including any legal, regulatory, tax or other consequences) associated with an investment and should seek independent professional advice. Some of the investment strategies or financial instruments described or alluded to herein may be construed as high risk and not readily realisable investments, and may experience substantial & sudden losses including total loss of investment. These are not suitable for all types of investors. Unigestion has the ability in its sole discretion to change the strategies described herein.

PAST PERFORMANCE

Past performance is not a reliable indicator of future results, the value of investments, can fall as well as rise, and there is no guarantee that your initial investment will be returned. Returns may increase or decrease as a result of currency fluctuations.

NO INDEPENDENT VERIFICATION OR REPRESENTATION

No separate verification has been made as to the accuracy or completeness of the information herein. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of information from third party sources. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

FORWARD-LOOKING STATEMENTS

This document may contain forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect Unigestion’s views as of such date with respect to possible future events and are subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond a strategy’s or Unigestion’s control. You are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward-looking statements in this document.

TARGET RETURNS

Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Target returns are based on Unigestion’s analytics including upside, base and downside scenarios and might include, but are not limited to, criteria and assumptions such as macro environment, enterprise value, turnover, EBITDA, debt, financial multiples and cash flows. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

USE OF INDICES

Information about any indices shown herein is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison. You cannot invest directly in an index and the indices represented do not take into account trading commissions and/or other brokerage or custodial costs. The volatility of the indices may be materially different from that of the strategy. In addition, the strategy’s holdings may differ substantially from the securities that comprise the indices shown.

ASSESSMENTS

Unigestion may, based on its internal analysis, make assessments of a company’s future potential as a market leader or other success. There is no guarantee that this will be realised.

No prospectus has been filed with a Canadian securities regulatory authority to qualify the distribution of units of this fund and no such authority has expressed an opinion about these securities. Accordingly, their units may not be offered or distributed in Canada except to permitted clients who benefit from an exemption from the requirement to deliver a prospectus under securities legislation and where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the applicable offering memorandum which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses.

Legal Entities Disseminating This Document

United Kingdom

This material is disseminated in the United Kingdom by Unigestion (UK) Ltd., which is authorized and regulated by the Financial Conduct Authority (“FCA”).

This information is intended only for professional clients and eligible counterparties, as defined in MiFID directive and has therefore not been adapted to retail clients.

United States

In the United States, Unigestion is present and offers its services in the United States as Unigestion (US) Ltd, which is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and/or as Unigestion (UK) Ltd., which is registered as an investment advisor with the SEC. All inquiries from investors present in the United States should be directed to clients@unigestion.com. This information is intended only for institutional clients that are qualified purchasers as defined by the SEC and has therefore not been adapted to retail clients.

European Union

This material is disseminated in the European Union by Unigestion Asset Management (France) SA which is authorized and regulated by the French “Autorité des Marchés Financiers” (“AMF”).

This information is intended only for professional clients and eligible counterparties, as defined in the MiFID directive and has therefore not been adapted to retail clients.

Canada

This material is disseminated in Canada by Unigestion Asset Management (Canada) Inc. which is registered as a portfolio manager and/or exempt market dealer in nine provinces across Canada and also as an investment fund manager in Ontario, Quebec and Newfoundland & Labrador. Its principal regulator is the Ontario Securities Commission (“OSC”).

This material may also be distributed by Unigestion SA which has an international advisor exemption in Quebec, Saskatchewan and Ontario. Unigestion SA’s assets are situated outside of Canada and, as such, there may be difficulty enforcing legal rights against it.

Switzerland

This material is disseminated in Switzerland by Unigestion SA which is authorized and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”).

Related insight

- Private equity

- Corporate

Unigestion has won “Private Equity Manager of the Year” at the European Pensions Awards 2025. The award, which Unigestion has now won seven times, recognises our expertise in the private equity space and our passion for helping Europe’s pension funds get the most from this complex area of the market.

[…]- Equities

- Press releases

Kepler Cheuvreux and Unigestion have now received all regulatory approvals ahead of the launch of Kepler Unigestion, a new partnership focused on quantitative strategies for listed equities.

[…]- Equities

- Webinar

Watch as our excellent panelists, Fundamental Analysts Fleura Shiyanova and Joachim Hermann, dissect the potential impact of renewed trade tensions, policy volatility and market sentiment swings – all hallmarks of the Trump playbook.

[…]- Equities

- Perspectives

Emerging managers, those who are launching their first or second funds, are often viewed sceptically by investors. However, these perceptions are often rooted in myth, not reality.

[…]