- Private equity

- Papers

- Perspectives

Paul Newsome

Head of Investment Solutions

Private Equity

- The overall market continues to show subdued investment and exit activity

- The main topic of concern for investors is liquidity which should drive attractive secondaries opportunities

- Despite the slowing market, we have exited eight companies from our direct programmes in the last 12 months at highly attractive multiples

- In this environment, our secondaries strategy is to target a blend of GP-led deals, LP stakes and direct secondaries to deliver an attractive cash flow profile for investors while optimising TVPI, IRR and DPI in a cost efficient (low TER) way

Overview

Despite anecdotal reports of scattered deal doing, the odd headline-grabbing exit and multiple fund managers on the road fundraising, the overall market data continues to show subdued activity. The post-COVID heights reached in 2021 remain a distant memory.

Investment activity in Q3 was stable vs Q2 but the overall year-to-date is almost 40% down vs the same period last year. The story is similar for exit activity which remains down this year compared to 2022. In fact, distributions back to investors relative to total AUM is at its lowest level for more than a decade. Thus, the main topic of concern for investors in private equity right now is liquidity. The general lack of predictability of when capital will be returned (and at what multiple of invested) is effectively limiting investors from making further commitments. Is it perhaps time for secondaries?

Nor any Drop to Drink

The global aggregate value of private equity deals closed during Q3 was USD 109bn, 2% down on the same quarter last year. Regional numbers were mixed with declines in North America (-19%) and APAC (-40%) while there was an increase in activity in Europe (+41%). However, this was likely due to local seasonal factors since total investment activity for the year-to-date across all regions shows a clear decline versus the same period last year (North America, -41%; Europe, -19%, APAC, -43%).

While exit activity increased compared to the same quarter one year ago, the year‑to‑date numbers also show a decline. The global aggregate value of exits was EUR 106bn, an increase of 32% versus the same quarter last year. However, given the slow first half, the total exit actively for the year-to-date was down 23%, driven by North America (-32%) and APAC (-46%) while Europe (29%) is up on the year.

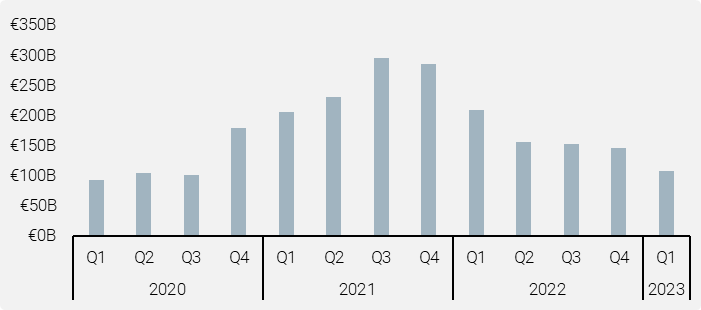

Figure 1: Exit Activity and Distributions as a % of Total NAV

Source: Preqin, October 2023.

However, while total exit activity is on course to be at a similar level to the pre-COVID years of 2016 to 2020, this should be seen in the context of aggregate NAV which has almost doubled in the last five years. By converting exit volume into proceeds to investors[1], we see that distributions in 2023 are estimated to be at only 7% of total NAV. This is the lowest level in more than a decade and such a reduction in relative liquidity creates issues for investors. Those investors with mature or maturing private equity programs are seeing more capital calls than distributions. Consequently, many investors will need to slow down the pace of new commitments. While, at worst, some investors will need to resort to the secondary market.

The Art of Exiting Companies

This is the overall picture of the private equity market. However, at Unigestion, we have been witnessing a different story. In 2022, we had our best year ever for exits – across direct and secondaries investments, we exited companies at an attractive multiple of original cost. This consistently high pace of exits has continued into 2023. In the last 12 months, we have exited eight companies from our direct programmes at an average multiple of 3.4x cost. Recent examples include:

Tapi. In February, Tapi was sold to Stirling Square Capital Partners for EUR 320m. Tapi is a global leader in the high-growth, premium bottle closures market with production facilities in Italy, France, Mexico and Argentina. We invested in the company alongside Wise Equity in 2017 when the company had revenues of EUR 35m. Thanks to investments in production capacity and efficiency as well as M&A activity (the group notably acquired Les Bouchages Delage in 2019), Tapi’s revenue has almost quadrupled since we initially invested.

Transporeon. In April, Transporeon was sold to Trimble, a US transportation management software provider, for USD 2bn. Transporeon is a leading European freight connectivity SaaS platform which provides applications to support a global network of more than 150,000 carriers and 1,400 shippers and retailers with an integrated suite of IT tools. Since our investment in 2019, the business has shown strong growth. The sale follows a competitive process with interest from multiple parties (both private equity and trade).

Guestline. In July, Guestline was sold to Access Group, a portfolio company of HgCapital, TA Associates and GIC. Guestline is a UK-based provider of mission critical software for the hospitality sector. Guestline serves a broad customer base, spanning leading independent hotels, multi-property groups, and delivering a leading end-to-end, distribution, hotel property management and guest experience system that unlocks more revenue, guest satisfaction and agility. This is another good example of the resilience of a market leader. During COVID, the hospitality sector overall suffered but given the mission criticality of the offering, the company was able to limit the impact and then thrive on the COVID recovery.

What does it take for a company to be sold in this environment, let alone at an attractive multiple? There are several concerns that buyers have to overcome: (i) interest rates are higher than they have been for 13 years, (ii) inflation is higher than it has been for 40 years, (iii) a recession is likely in the near term, and (iv) supply chains are under stress due to geopolitical uncertainties.

Therefore, the bar is clearly very high and only companies meeting strict criteria will be attractive to buyers. We believe the following criteria are important: (i) growth uncorrelated to GDP, (ii) leading company in its sector, (iii) mission critical offering (i.e. customers cannot do without it), (iv) high EBITDA margin giving buffer in case of difficult times, and (v) strong balance sheet with limited leverage.

In fact, companies with the above features will stand out even more in a tough environment and thus attract concentrated interest from buyers.

This is an extremely important principal behind our investment strategy, which we call “targeting the market leaders of tomorrow”. We apply this across all of our strategies: direct investments, secondaries, emerging and established managers, and climate impact investments.

Difficult Times Lead to Great Deals

Fundraising has never been so polarised. While overall fundraising volume was USD 121bn, 78% up from Q3 last year, this came from only 68 funds versus 81 funds in Q3 2022[2]. Indeed, five mega cap funds raised in Q3 represented over 60% of the fundraising volume. Thus, the average fund size closed was over USD 2bn – by far the highest in the last 10 years. This suggests that the fundraising party is continuing for the large and mega cap managers, while the mid-market managers are having a tougher time.

However, those few mid-market managers who have successfully raised capital should be able to now benefit from correspondingly less competition for deals.

We are seeing this with our direct strategy, where we have now made seven investments in high quality companies, applying our strategy of targeting market leaders of tomorrow.

In October 2023, we invested in Marengo Asia Healthcare, a leading multispecialty hospital chain in India which provides tertiary and quaternary care (e.g. oncology, neurology, gastroenterology, gynaecology, etc.). The company currently consists of three hospitals with a total capacity of 1,230 beds. Marengo plans to make acquisitions of mid-sized (250-500 bed) hospitals located in the top 20 Indian cities with a focus on capacity utilisation and service mix to drive further growth. This is a unique situation where we could invest into the company alongside the GP, Samara Capital, two years after the initial investment in order to provide capital for two further acquisitions.

We have an attractive pipeline of deals and, notwithstanding the current environment, expect to close further investments in the coming months.

Secondaries: Optimising the Strategy

We have spoken before about how the current environment should be a boon for the secondaries market, and indeed this is coming to pass. However, given the increasing sophistication of the market and the consequent breadth of deals – from LP stakes to GP-leds, from single asset to multi asset, and from leverage to no leverage – what is the optimum strategy in this environment? We consider below the prevailing deal types with their advantages and disadvantages from a portfolio construction point of view:LP stakes. These give investors access to mature portfolios potentially on the verge of making attractive distributions. When it is a buyer’s market like now, such stakes can be purchased at attractive discounts to NAV and can lead to high IRRs (albeit with lower TVPIs). However, there are disadvantages to be aware of. Firstly, the total expense ratio (TER) is high as full fee and carried interest will be payable. Secondly, distributions will still be slower in a difficult exit market, and there is the likelihood of a long tail. Finally, secondaries players who mainly invest in LP stakes have historically relied on cheap debt to boost returns. This will not be the case going forward, especially when most large transactions are intermediated. Debt facilities, whether credit line financing or NAV financing, have increased in cost by over 500bps in the last two years. The days of free money are over.

GP-led transactions. With a slow exit market, GPs often turn to the option of continuation funds consisting of one or more of their best-performing companies in order to provide liquidity back to investors. This gives secondaries investors access to market-leading companies in defensive sectors that come with attractive risk mitigating features: a company that the GP knows well, tangible and credible value creation plans, and strong alignment. Effectively, a GP-led deal is a chance to invest along an insider. In addition, fees and carried interest tend to be lower than for a normal fund, especially when staggered carry and/or high hurdles are negotiated. On the negative side, the holding period can be up to five years, leading to lower cash velocity compared to a traditional secondaries fund. Secondly, an underperforming single asset GP-led will be difficult to get rid of in the secondaries market, given the high concentration.

Direct secondaries. These are investments directly into a portfolio company of a GP, either to buy out existing shareholders or to provide additional capital to make add-on acquisitions or provide other growth capital needs. The important feature is that, similar to a traditional co-investment, they are typically negotiated on a no fee, no carried interest basis. The holding period can also be short since the GP will have already owned the asset for two to five years. On the negative side, there is less alignment since there is no specific GP commitment and a secondaries investor may come in at a different valuation. However, similar to single asset GP-led transactions, the deals will clearly be more concentrated than an LP-stake deal or multi-asset GP‑led deal.

Our view is that the optimum secondaries strategy should take advantage of all of the above deal types, achieving a deliberate allocation to each one. Combining with other portfolio management tools such as recycling early distributions, this strategy then builds a highly attractive cash flow profile for investors while optimising TVPI, IRR and payback period in a very cost efficient (low TER) way. We call this our “fusion strategy” and have applied this across our secondaries funds since 2013.

This optimisation mindset goes further. When considering a GP-led deal, we look for situations with shorter holding periods or opportunities to quickly de-risk a portfolio through short-term distributions. For an LP-stake deal, we focus on single fund deals of GPs we know well, where we can do detailed bottom-up due diligence for each company. This allows us to target portfolios of companies that are market leaders and are thus more attractive to buyers – even in a difficult exit environment. In addition, it helps us avoid the high tail-end risk which is more prevalent with larger multi-line portfolios whereby certain funds take a long time to liquidate their last positions.

An example of a GP-led deal which we exited after a short hold is Coastal Waste, a single asset continuation fund in our Secondaries strategy. Coastal Waste is a vertically integrated waste management company in South Florida in which we invested in Q3 2021. We were initially attracted by the strong tailwinds, the predictable revenues of long customer contracts, a highly aligned and experienced GP and, importantly, a visible pipeline of acquisition targets. In April 2023, after less than two years, the company was sold to an infrastructure fund, delivering highly attractive returns to our investors.

In October, we exited Yaveon, a German-based ERP software implementation and consulting firm. We invested in this single asset continuation fund at the end of 2020, together with German private equity firm Afinum. The company grew strongly thanks to its strong customer base and was finally sold to Volpi, an upper mid-market private equity firm at an attractive multiple less than three years later.

We have been successfully investing in secondaries since 2000. Some of our best deals have come during difficult economic periods. However, irrespective of macro conditions, our secondaries strategies have always delivered consistent returns with very low loss ratios. As we continue to source a rich supply of LP-stakes, GP-led deals and Direct secondaries consisting of high quality “market leaders of tomorrow” from our network, we believe that this coming vintage will be one of the best on record.

[1]We assume c50% of the transaction value of an exited company is paid as proceeds back to investors with the rest going to the debt holders and other minority investors

[2] Preqin, October 2023

Unigestion Private Equity Activity

Here are the highlights of some of the investments that we completed in Q3

In August, Unigestion commited to Riverside Europe VII. Riverside Europe is a Pan-European manager with several offices across Europe and is advised by a team of 16 investment professionals. Riverside Europe focuses on buyout investments in mid-market companies operating in DACH, Benelux, Nordics, and Southern Europe. The firm seeks to make primary investments in scalable and healthy companies in need of a strategic partner, with a focus on internationalising such companies with the support of Riverside’s global resources.

In September, Unigestion completed a direct secondary investment into France-headquartered Clayens NP alongside One Equity Partners. Clayens, founded in 1931, is a value-added outsourced contract manufacturer of high-performance polymers, composites and precision materials. The company produces highly-engineered products designed to its clients’ specifications and serves customers across a variety of end-markets, including electric and electronics, industrial equipment, automotive, home appliances, healthcare, and aerospace and defence. With the continued trend in North America and Europe of reshoring to reduce supply-chain risk as well as substituting metal with high-quality polymers for cost, weight, and durability benefits, the company is supported by favourable tailwinds.

Also in September, Unigestion acquired a diversified portfolio of companies with an attractive deal structure and cash flow profile. The transaction consists of Norwest Equity Partners IX, Norwest Equity Partners X and a staple to Norwest Equity Partners XI. Norwest Equity Partners is a US manager with 60+ years of experience investing across multiple regions and strategies. The firm focuses on building fundamentals, and professionalising businesses using their functional expertise across HR, legal, finance, strategy, leadership and digital. The portfolio spans various industries including business services, distribution, tech-enabled services, wellness & fitness and industrials with strong free cash flow characteristics, recurring demand dynamics and exposure to multiple end markets.

In the same month, Unigestion closed a direct secondary investment into Germany-headquartered SCIO Automation alongside Quadriga Capital and AEA Investors. SCIO, founded in 2019, is an industrial automation company active in intralogistics, discrete automation and process automation. The group has been growing significantly over the past few years and consists of nine individual brands with a geographical focus on Europe and North America. SCIO Automation is active in a EUR 18bn market that is expected to grow by 9% – 10% p.a.

Important information

INFORMATION ONLY FOR YOU

This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person without the prior written consent of Unigestion. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

RELIANCE ON UNIGESTION

There is no guarantee that Unigestion will be successful in achieving any investment objectives. An investment strategy contains risks, including the risk of complete loss.

Except where otherwise specifically noted, the information contained herein, including performance data and assets under management, relates to the entire affiliated group of Unigestion entities over time. Such information is intended to provide you with background regarding the services, investment strategies and personnel of the Unigestion entities. No guarantee is made that all or any of the individuals involved in generating the performance on behalf of one or more Unigestion entities will be involved in managing any specific client account on behalf of another Unigestion entity.

NOT A RECOMMENDATION OR OFFER

This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in either the investment vehicles to which it refers or to any securities or financial instruments described herein. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Such documentation contains additional information material to any decision to invest. Please contact your professional adviser/consultant before making an investment decision.

Reference to specific securities should not be construed as a recommendation to buy or sell such securities and is included for illustration purposes only.

RISKS

Where possible we aim to disclose the material risks pertinent to this document. The views expressed in this document do not purport to be a complete description of the securities, markets and developments referred to in it. Unigestion maintains the right to delete or modify information without prior notice. The risk management practices and methods described herein are for illustrative purposes only and are subject to modification.

Investors shall conduct their own analysis of the risks (including any legal, regulatory, tax or other consequences) associated with an investment and should seek independent professional advice. Some of the investment strategies or financial instruments described or alluded to herein may be construed as high risk and not readily realisable investments, and may experience substantial & sudden losses including total loss of investment. These are not suitable for all types of investors. Unigestion has the ability in its sole discretion to change the strategies described herein.

PAST PERFORMANCE

Past performance is not a reliable indicator of future results, the value of investments, can fall as well as rise, and there is no guarantee that your initial investment will be returned. Returns may increase or decrease as a result of currency fluctuations.

NO INDEPENDENT VERIFICATION OR REPRESENTATION

No separate verification has been made as to the accuracy or completeness of the information herein. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of information from third party sources. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

FORWARD-LOOKING STATEMENTS

This document may contain forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect Unigestion’s views as of such date with respect to possible future events and are subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond a strategy’s or Unigestion’s control. You are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward-looking statements in this document.

TARGET RETURNS

Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Target returns are based on Unigestion’s analytics including upside, base and downside scenarios and might include, but are not limited to, criteria and assumptions such as macro environment, enterprise value, turnover, EBITDA, debt, financial multiples and cash flows. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

USE OF INDICES

Information about any indices shown herein is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison. You cannot invest directly in an index and the indices represented do not take into account trading commissions and/or other brokerage or custodial costs. The volatility of the indices may be materially different from that of the strategy. In addition, the strategy’s holdings may differ substantially from the securities that comprise the indices shown.

ASSESSMENTS

Unigestion may, based on its internal analysis, make assessments of a company’s future potential as a market leader or other success. There is no guarantee that this will be realised.

No prospectus has been filed with a Canadian securities regulatory authority to qualify the distribution of units of this fund and no such authority has expressed an opinion about these securities. Accordingly, their units may not be offered or distributed in Canada except to permitted clients who benefit from an exemption from the requirement to deliver a prospectus under securities legislation and where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the applicable offering memorandum which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses.

Legal Entities Disseminating This Document

United Kingdom

This material is disseminated in the United Kingdom by Unigestion (UK) Ltd., which is authorized and regulated by the Financial Conduct Authority (“FCA”).

This information is intended only for professional clients and eligible counterparties, as defined in MiFID directive and has therefore not been adapted to retail clients.

United States

In the United States, Unigestion is present and offers its services in the United States as Unigestion (US) Ltd, which is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and/or as Unigestion (UK) Ltd., which is registered as an investment advisor with the SEC. All inquiries from investors present in the United States should be directed to clients@unigestion.com. This information is intended only for institutional clients that are qualified purchasers as defined by the SEC and has therefore not been adapted to retail clients.

European Union

This material is disseminated in the European Union by Unigestion Asset Management (France) SA which is authorized and regulated by the French “Autorité des Marchés Financiers” (“AMF”).

This information is intended only for professional clients and eligible counterparties, as defined in the MiFID directive and has therefore not been adapted to retail clients.

Canada

This material is disseminated in Canada by Unigestion Asset Management (Canada) Inc. which is registered as a portfolio manager and/or exempt market dealer in nine provinces across Canada and also as an investment fund manager in Ontario, Quebec and Newfoundland & Labrador. Its principal regulator is the Ontario Securities Commission (“OSC”).

This material may also be distributed by Unigestion SA which has an international advisor exemption in Quebec, Saskatchewan and Ontario. Unigestion SA’s assets are situated outside of Canada and, as such, there may be difficulty enforcing legal rights against it.

Switzerland

This material is disseminated in Switzerland by Unigestion SA which is authorized and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”).

Document issued May 2024.

Related insight

- Private equity

- Corporate

Unigestion has won “Private Equity Manager of the Year” at the European Pensions Awards 2025. The award, which Unigestion has now won seven times, recognises our expertise in the private equity space and our passion for helping Europe’s pension funds get the most from this complex area of the market.

[…]- Equities

- Press releases

Kepler Cheuvreux and Unigestion have now received all regulatory approvals ahead of the launch of Kepler Unigestion, a new partnership focused on quantitative strategies for listed equities.

[…]- Equities

- Webinar

Watch as our excellent panelists, Fundamental Analysts Fleura Shiyanova and Joachim Hermann, dissect the potential impact of renewed trade tensions, policy volatility and market sentiment swings – all hallmarks of the Trump playbook.

[…]- Equities

- Perspectives

Emerging managers, those who are launching their first or second funds, are often viewed sceptically by investors. However, these perceptions are often rooted in myth, not reality.

[…]